What’s the Latest News on PVH Corporation?

PVH Corporation (PVH) has a market cap of $7.5 billion. It fell 1.6% and closed at $93.30 per share on January 26, 2017.

Jan. 27 2017, Published 1:00 p.m. ET

Price movement

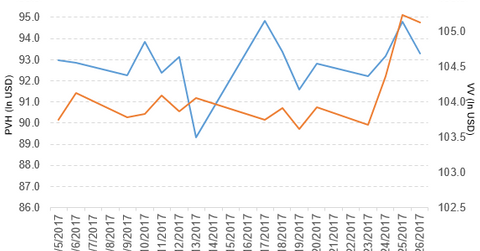

PVH Corporation (PVH) has a market cap of $7.5 billion. It fell 1.6% and closed at $93.30 per share on January 26, 2017. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 1.9%, 3.6%, and 3.4%, respectively, on the same day. PVH is trading 1.2% above its 20-day moving average, 5.7% below its 50-day moving average, and 7.0% below its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.04% of its holdings in PVH. VV’s YTD price movement was 2.7% on January 26.

The market caps of PVH’s competitors are as follows:

Latest news on PVH

In a press release, PVH reported, “PVH Corp. (PVH) announced today that it has entered into an agreement into an agreement to acquire the licensed Tommy Hilfiger men’s tailored clothing business for North America from Marcraft Clothes, Inc. Marcraft operates the business under license from Tommy Hilfiger Licensing LLC, a wholly owned subsidiary of PVH. As part of the transaction, PVH will acquire certain assets related to the licensed business and the license agreement would be terminated effective December 31, 2017. PVH intends to consolidate the North America men’s tailored businesses for all of its brands under one partner, Peerless Clothing International, Inc., beginning January 2018. Terms of the transaction were not disclosed.”

Performance in 3Q16

PVH reported 3Q16 total revenues of $2.24 billion—a rise of 3.7% compared to total revenues of $2.16 billion in 3Q15. The company’s gross profit margin expanded by 220 basis points, while its EBIT[1. earnings before interest and taxes] margin narrowed by 290 basis points in 3Q16—compared to 3Q15.

Its net income and EPS (earnings per share) fell to $126.2 million and $1.56, respectively, in 3Q16—compared to $221.9 million and $2.67, respectively, in 3Q15. It reported non-GAAP (generally accepted accounting principles) EPS of $2.60 in 3Q16—a fall of 2.3% compared to 3Q15.

PVH’s cash and cash equivalents rose 79.1% and its inventories fell 5.5% between 3Q16 and 4Q15.

Projections

PVH made the following projections for fiscal 2016:

- PVH projects revenue growth of ~2% based on a GAAP basis and ~3% on a constant currency basis. It projects revenue growth for its Calvin Klein, Tommy Hilfiger, and Heritage Brands businesses of 6%, 4%, and -9%, respectively, on a GAAP basis.

- The company expects non-GAAP EPS of $6.70–$6.75, which includes the negative impact of foreign currency exchange rates of ~$1.65 per share.

PVH made the following projections for 4Q16:

- revenue growth of -1%–1% on a constant currency basis

- non-GAAP EPS of $1.13–$1.18, which includes the negative impact of foreign currency exchange rates of $0.23 per share

In the next part of this series, we’ll discuss Harman International Industries (HAR).