Volatility among the Miners in 2017

Sibanye Gold, Gold Fields, Agnico-Eagle Mines, and Pan American Silver had RSI levels of 51.4, 54.6, 59.4, and 58.8, respectively.

Jan. 27 2017, Updated 7:38 a.m. ET

Precious metal funds

As we saw in the previous part of this series, many of the fluctuations in precious metals resulted from speculation about the Federal Reserve’s interest rate stance. Now, let’s take a look at the fundamentals of South African precious metal miners.

Precious metal–based funds such as the ProShares Ultra Silver ETF (AGQ) and the Direxion Daily Gold Miners ETF (NUGT) have seen a revival in their prices in the last month. Mining stocks often show more volatility than metals themselves.

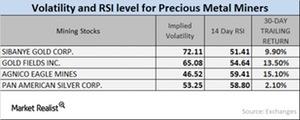

Next, let’s look at the implied volatilities of large mining stocks and their RSI (relative strength index) levels in the wake of the carnage of precious metal prices. We’ll look at Sibanye Gold (SBGL), Gold Fields (GFI), Agnico-Eagle Mines (AEM), and Pan American Silver (PAAS).

Implied volatility

Call implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option. During times of global and economic turbulence, volatility is higher than in a stagnant economy.

The volatilities of Sibanye Gold, Gold Fields, Agnico-Eagle Mines, and Pan American Silver were 72.1%, 65.1%, 46.5%, and 53.3%, respectively, on January 11, 2017.

RSI levels

The RSI levels for each of these four mining giants rose due to their rising prices. Sibanye Gold, Gold Fields, Agnico-Eagle Mines, and Pan American Silver had RSI levels of 51.4, 54.6, 59.4, and 58.8, respectively.

The trailing 30-day returns of most mining companies are positive due to precious metals’ diminishing safe-haven appeal. These four have 30-day trailing gains of 9.9%, 13.5%, 15.1%, and 2.1%, respectively.