3M’s Pension Plan, Post-Retirement Benefits, and the Rate Hike

3M (MMM) offers defined benefit plans to all its US employees and those outside the United States as a well. Overall, the company has 80 defined plans across 28 countries.

Jan. 11 2017, Updated 11:36 a.m. ET

3M’s pension and post-retirement benefit plans

3M (MMM) offers defined benefit plans to all its US employees and those outside the United States as a well. Overall, the company has 80 defined plans across 28 countries.

3M’s pension benefit plans are calculated based on each participant’s years of service, compensation, and age at the point of retirement. 3M closed its primary defined pension benefits plan to new participants effective January 1, 2009.

3M also offers defined contribution plans to all its US employees. All employees who joined the company after January 1, 2009, are part of this program. 3M contributed $165 million, $153 million, and $136 million in 2015, 2014, and 2013, respectively.

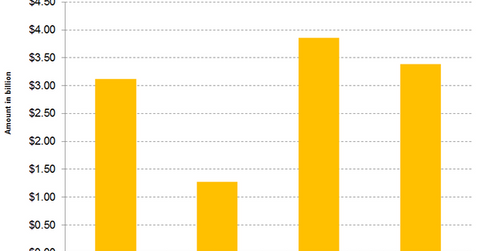

Unfunded status

3M’s unfunded status in the past four years has been in the range of $3 billion–$3.6 billion, with the exception of 2013 due to actuarial gains of $1.4 billion from benefit plans and post-retirement plans. At the end of 2015, 3M’s unfunded status stood at $3.4 billion across all pension plans.

3M’s peer General Electric (GE) was underfunded by $33.3 billion, United Technologies (UTX) was underfunded by $4.4 billion, and Textron (TXT) was underfunded by $1.2 billion at the end of 2015.

Impact of the interest rate hike on pension plans

The Federal Reserve’s December 2016 rate decision is expected to benefit 3M’s pension plan due to the higher discount rate that will be applied for calculation as a result of the interest rate rise.

Interest rates directly influence the discount rate. According to MMM’s estimates, a 0.25% rise in the discount rate would benefit it by $49 million, resulting in the reduction of its underfunded status.

Notably, investors can indirectly hold 3M by investing in the Industrial Select Sector SPDR ETF (XLI), which has invested 5.3% of its portfolio in 3M as of January 10, 2017.