What a Trump Presidency Means for Municipal Bonds

After investors’ post-election U-turn, some tailwinds turned to headwinds for municipal bonds. Investors moved money out of bond funds amid expectations of a Fed rate hike.

Dec. 2 2019, Updated 9:51 a.m. ET

VanEck

While we remain bullish on the municipal asset class going into 2017 (see Jim’s post A Case for Municipal Bond Optimism), Donald Trump’s upset win over Hillary Clinton in the 2016 election caught many people in the investment community by surprise. We will examine what the aftermath of the 2016 election may portend for municipal bonds going forward.

Background

In the week leading up to the election, the municipal bond market had just emerged from a somewhat turbulent October, owing to greatly elevated supply coming into the marketplace. The excess supply caused muni bond prices to decline, and brought to an end a remarkable 54-month string of net inflows into muni bond-centric vehicles, based on data from Morningstar.

Market Realist

Muni bonds in red after a long time

After investors’ post-election U-turn, some tailwinds turned to headwinds for municipal (or muni) bonds. Investors moved money out of bond funds amid expectations that the Federal Reserve would soon be raising interest rates against the backdrop of an improving economy.

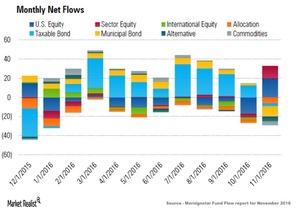

As you can see in the above graph, taxable bond funds bled $2.9 billion in November. Municipal bond funds were hit hardest with $10.5 billion in outflows, the biggest tally of net redemptions since August 2013.

What caused this fall?

Muni bonds (MLN) (SHM) outperformed their taxable counterparts in 2015 as well as most of 2016. The fall started in October when the muni issuance reached a record supply, but there was no one to buy them.

Due to bonds and their inverse relationship, the excess supply caused yields to rise and the price to fall. This was evident in the ten-year muni yield that rose to 2.6% in the first week of December from a record low of 1.3% in the last week of June, according to Bloomberg.

This situation was further aggravated due to president-elect Donald Trump’s proposed tax reforms that could lead to the elimination of muni tax exemptions. Muni bond (HYD) (SMB) (ITM) income is generally exempt from federal and state taxes.

Proposed infrastructure spending could also lead to increased muni issuance in the coming months. That could be a huge downside for an already oversupplied muni market and could pull down prices in the future.

Looking forward, the muni market will unfold where overall interest rates are headed. If the Fed continues to raise short interest term rates, it could lift its long-term counterparts as well, including muni yields.

In the next part of this series, we’ll take a look at how proposed tax reforms could impact the muni market.