Which Segment Is Ctrip’s Biggest Contributor to Growth?

Hotels make up a significant part of Ctrip’s revenues—39% of total revenues in 2Q16—similar to OTA peers Priceline, Expedia, and TripAdvisor.

Nov. 20 2020, Updated 3:04 p.m. ET

Hotel reservation

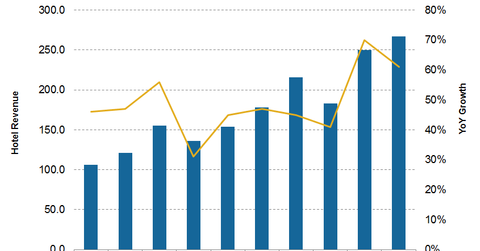

Hotels make up a significant part of Ctrip.com International’s (CTRIP) revenues—39% of total revenues in 2Q16—similar to OTA (online travel agency) players Priceline (PCLN), Expedia (EXPE), and TripAdvisor (TRIP). In 2Q16, Ctrip’s Hotel revenues grew by 61% to $267 million on high volume growth and the consolidation of Qunar’s (QUNR) financials. The company’s management stopped providing volume numbers in 4Q15. In the first quarter of 2016, Ctrip’s Hotel revenues grew by 70% YoY (year-over-year) to $250 million.

Transportation

Transportation revenues formed 44% of CTRP’s 2Q16 revenues. In 2Q16, this segment’s revenues grew 90% to $302 million due to strong volume growth in bus tickets, and Ctrip expects to become a hub for this market. Train and bus volumes are expected to exceed air ticket volumes as well, mainly due to a low base effect. However, in value terms, these volumes are still small.

Consolidating Qunar’s (QUNR) financials has definitely helped, given QUNR’s strong travel portfolio. For 1Q16, its Transportation revenues have grown by 106% to $302 million.

Packaged Tours segment

Packaged Tours made up ~10% of Ctrip’s 2Q16 revenue. In 2Q16, this segment’s revenues grew 44% to $71 million on growth in organized and self-guided tours. In 1Q16, packaged tour revenues grew 41%.

Corporate Travel segment

Corporate Travel made up 3% of Ctrip’s 2Q16 revenues. In 2Q16, this segment’s revenues grew ~22% to $21 million, and in 1Q16, the segment’s revenues grew ~25% to $18 million.

Guidance

Strong volume growth in the Hotels and Transportation segments should continue to offset the impact of declining revenue per room night per ticket, helping Ctrip achieve revenue growth.

For 3Q16, management expects the company’s Hotel revenues to grow 50%–55% YoY. Transportation revenues are expected to grow 90%–95% YoY, and Packaged Tours are expected to grow 35%–40% YoY, while the Corporate segment is expected to grow 10%–20% YoY.

Notably, investors can gain exposure to Ctrip.com by investing in the PowerShares NASDAQ Internet Portfolio (PNQI), which invests 3.2% of its total holdings in Ctrip.