Drew Industries Declares Dividend of $0.50 Per Share

Drew Industries rose 1.9% to close at $99.60 per share on November 17. The stock’s weekly, monthly, and YTD price movements were 11.0%, 7.4%, and 65.5%.

Nov. 21 2016, Updated 10:05 a.m. ET

Price movement

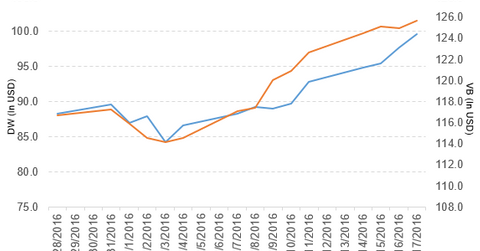

Drew Industries (DW) has a market cap of $2.4 billion and rose 1.9% to close at $99.60 per share on November 17, 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 11.0%, 7.4%, and 65.5%, respectively, on the same day.

DW is now trading 9.8% above its 20-day moving average, 6.0% above its 50-day moving average, and 24.1% above its 200-day moving average.

Related ETF and peers

The Vanguard Small-Cap ETF (VB) invests 0.07% of its holdings in Drew Industries. The YTD price movement of VB was 14.7% on November 17.

The market caps of DW’s competitors are as follows:

- Thor Industries (THO): $4.5 billion

- Berkshire Hathaway (BRK.A): $377.7 billion

Drew Industries’ dividend and latest news

Drew Industries has declared a regular quarterly cash dividend of $0.50 per share on its common stock. The dividend will be paid on December 9, 2016, to shareholders of record at the close of business on November 28, 2016.

Notably, Brian Hall has been appointed as Drew Industries’ chief financial officer, effective immediately.

3Q16 performance

Drew Industries reported 3Q16 net sales of $412.4 million—a YoY (year-over-year) rise of 19.4%, as compared to its net sales of $345.3 million in 3Q15. The company’s gross profit margin and operating margin expanded by 410 basis points and 300 basis points, respectively, YoY in 3Q16.

Its net income and EPS (earnings per share) rose to $29.8 million and $1.19, respectively, in 3Q16, as compared to $17.3 million and $0.70, respectively, in 3Q15.

DW’s inventories fell 9.8% YoY in 3Q16. It reported cash and cash equivalents of $95.1 million in 3Q16, as compared to $7.3 million in 3Q15. Its current ratio rose to 2.4x, and its debt-to-equity ratio fell to 0.46x in 3Q16, as compared to a current ratio and a debt-to-equity ratio of 2.2x and 0.60x, respectively, in 3Q15.

In the next and final part of this series, we’ll discuss J.M. Smucker (SJM).