Why Were Chinese Iron Ore Imports Weak in October?

China’s weaker iron ore imports Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In October, however, the imports were at their lowest since February, at 80.8 million tons, down 13% month-over-month. On a year-over-year basis, the imports rose 7%. In the first ten months of […]

Nov. 28 2016, Updated 11:04 a.m. ET

China’s weaker iron ore imports

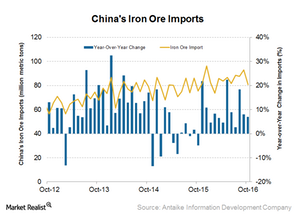

Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In October, however, the imports were at their lowest since February, at 80.8 million tons, down 13% month-over-month. On a year-over-year basis, the imports rose 7%. In the first ten months of 2016, iron ore imports reached 844 million tons, which was 9% higher than they were during the same period in 2015. Lately, Chinese mills have curtailed production, as costs have soared due to the shortage of coking coal.

Customs data and China’s iron ore imports

China tracks its iron ore imports through customs data. This information is important for investors because it provides a good sense of the appetite for imported iron ore among Chinese mills and traders. As China consumes about two-thirds of all seaborne iron ore, its import appetite impacts iron ore players involved in seaborne iron ore trade, including Cliffs Natural Resources (CLF), Vale (VALE), and Rio Tinto (RIO).

The iShares MSCI Global Metals & Mining Producers ETF (PICK) invests in iron ore, so this information affects it as well. BHP Billiton (BHP) is PICK’s top holding, making up 16.7% of the fund. The SPDR S&P Metals & Mining ETF (XME) also invests in some of these stocks.

Pullback in demand

Meanwhile, the supply of coking coal, another ingredient used in making steel, remains constrained, which could lead to higher steel prices. This factor could mean that the usual seasonal weakness in demand that sets in during September and October might remain tepid, and could result in higher iron ore prices. In the next part of this series, we’ll see what’s supporting the current trend in steel production in China.