Berenberg Rated BorgWarner as a ‘Sell’

On November 22, 2016, Berenberg has initiated the coverage of BorgWarner (BWA) with a “sell” rating and also set the stock’s price target at $28.00 per share.

Nov. 25 2016, Updated 8:04 a.m. ET

Price movement

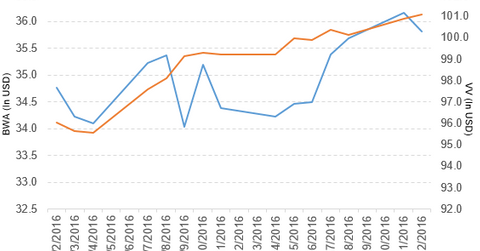

BorgWarner (BWA) has a market cap of $7.6 billion. It fell 0.97% to close at $35.81 per share on November 22, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 3.9%, 0.96%, and -16.2%, respectively, on the same day.

BWA is trading 2.3% above its 20-day moving average, 2.4% above its 50-day moving average, and 5.0% above its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.03% of its holdings in BorgWarner. The YTD price movement of VV was 9.8% on November 22.

The market caps of BorgWarner’s competitors are as follows:

BWA’s rating

On November 22, 2016, Berenberg has initiated the coverage of BorgWarner (BWA) with a “sell” rating and also set the stock’s price target at $28.00 per share.

According to Berenberg analyst Fei Teng, “BorgWarner’s dependence on emissions reduction technologies to drive growth skews risks to the downside. In the medium term, automakers are likely to gain increasing comfort with emissions targets in Europe due to a history of over-estimating the technology cost curve.”

Teng added, “BorgWarner’s 100% exposure to powertrain means it is the single supplier most heavily at risk from deferred content launches if this risk materializes. We see organic growth slowing below the guided range of 4-6% for 2016-18 and margins coming under increasing pressure from volume and pricing risks.”

Performance of BorgWarner in 3Q16

BorgWarner (BWA) reported 3Q16 net sales of $2.2 billion, a rise of 15.8% over its net sales of $1.9 billion in 3Q15. The company’s gross profit margin expanded 20 basis points, and its operating margin narrowed 580 basis points.

Its net income and EPS (earnings per share) fell to $83.3 million and $0.39, respectively, in 3Q16, compared to $157.4 million and $0.70, respectively, in 3Q15.

The company reported non-GAAP[1. generally accepted accounting principles] EPS of $0.78 in 3Q16, a rise of 6.8% over 3Q15. BWA’s cash and inventories fell 10.2% and 5.0%, respectively, between 4Q15 and 3Q16.

Quarterly dividend

BorgWarner has declared a quarterly cash dividend of $0.14 per share on its common stock. The dividend will be paid on December 15, 2016, to shareholders of record on December 1, 2016.

Projections

BorgWarner has made the following projections for 4Q16:

- net sales growth of 14.3%–17.8%

- EPS of $0.82–$0.86, including ~$0.02 per share from its Remy acquisition

The company has made the following projections for 2016:

- net sales growth of 15.2%–16.0%

- EPS of $3.24–$3.28, including ~$0.12 per share from its Remy acquisition

In the next part of this series, we’ll discuss Graphic Packaging Holding Company (GPK).