How Would Qualcomm Fund a Possible Acquisition of NXP?

If Qualcomm (QCOM) looks to buy NXP Semiconductors (NXPI), the deal could be valued at just above $30 billion or as high as $46 billion.

Nov. 20 2020, Updated 1:25 p.m. ET

Analysts and investors happy with acquisition possibility

In the previous part of the series, we saw that if Qualcomm (QCOM) looks to buy NXP Semiconductors (NXPI), the deal could be valued at just above $30 billion or as high as $46 billion.

The rumor of such a large-scale merger was received well by analysts and investors. Analysts have stated that NXP is the best use of Qualcomm’s strong cash balance, as a merger would be immediately accretive to its earnings.

However, the deal would also increase Qualcomm’s leverage. Despite this, the acquisition rumor was received well by Qualcomm investors, probably because they were happy the company finally took strategic action to boost growth in a slowing market. Let’s see how NXP would change Qualcomm’s balance sheet.

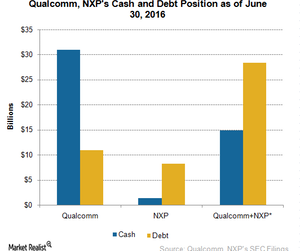

Qualcomm’s cash and debt position pre-merger

On June 2016, Qualcomm had cash reserves of $31 billion and long-term debt of $10.8 billion, resulting in net cash of $19.2 billion. On the other hand, NXP has cash reserves of $1.3 billion and long-term debt of $8.3 billion, resulting in net debt of $7 billion. However, the company is aiming to reduce this debt by refinancing and offloading non-core assets. It plans to use some portion of the $2.8 billion cash proceeds it will receive from the sale of its Standard Products Division to China’s JAC Capital to repay its debt.

Cost of debt

If Qualcomm makes an all-cash deal of around $35 billion for NXP and decides to fund 50% using cash reserves and 50% using debt, it would incur an additional interest expense of $875 million annually on a debt of $17.5 billion at a 5% interest rate.

If Qualcomm decides on a 50-50 cash-stock deal, it could either fund the entire $17.5 billion cash portion using its reserves or fund 50% of this amount, around $8.8 billion, through debt. This would result in an additional interest expense of $437.5 million. Funding the NXP acquisition through debt would prevent Qualcomm from exhausting its cash reserves.

Debt repayment

If Qualcomm raises new debt, it can channelize its annual free cash flow of around $4.5 billion toward debt repayment. This way, Qualcomm could avoid increasing its leverage to an alarming rate.

Broadcom (AVGO) and Analog Devices (ADI) have stalled their share buyback programs and channelized their cash flows toward debt repayment.

Merger synergies would also be immediately accretive to Qualcomm’s earnings, helping it to repay its debt even faster. We’ll look into these possible merger synergies in the next part of the series.