No Tapering, No Extension: ECB Avoids Future Talk on QE

ECB chief Mario Draghi had nothing to say about either tapering or extension of the bond buying program.

Oct. 24 2016, Published 9:49 a.m. ET

Fate of QE

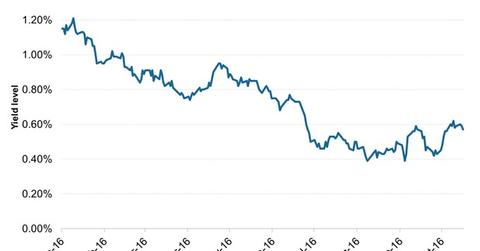

One of the key points that the market was looking forward to hearing about was the fate of the ECB’s (European Central Bank) quantitative easing program. Earlier this month, some unnamed ECB officials had told Bloomberg that the central bank may be thinking about tapering its bond-buying program, which led to a rise in yields across Europe. The graph below shows the movement in the ten-year Eurozone yield. As you can see, there is a rise towards the end of the graph.

ETFs like the SPDR Barclays International Treasury Bond ETF (BWX) and the iShares International Treasury Bond ETF (IGOV) are affected by sharp moves in government bond yields. Meanwhile, a general rise in interest rates could impact European banks like Deutsche (DB), Credit Suisse (CS), and Banco Santander (SAN) as well.

No talk on tapering or extension

However, the ECB chief Mario Draghi had nothing to say about either tapering or extension of the bond buying program. At present, the ECB conducts monthly asset purchases of 80 billion euros, which is expected to continue until March 2017 or beyond, if required.

Due to the speculation over tapering, participants in the press conference following the policy release wanted to know whether the ECB had discussed the issue. Several times during the press conference, Draghi said that the ECB had neither discussed the extension of the asset purchase program beyond March 2017 nor discussed tapering.

On another question regarding whether extension and tapering will be on the agenda in the December meeting, Draghi responded, “we haven’t really yet discussed that at all.”

Why the evasion?

All central banks are avoiding discussion on timing. The US Federal Reserve has stopped providing any reference to the timing of a rate hike and the Bank of Japan has removed any timeframe for inflation to reach its mandated level. Central banks seem to want to keep all options open. Since monetary policy has failed to deliver on time, or in some cases, at all, central banks do not want to discuss timing on any upcoming action at all.

On the issue of tapering, we think that tapering is on the table. While answering a question with reference to stopping asset purchases at one go, Draghi replied, “I would say, an abrupt ending to bond purchases? I think it’s unlikely.”

In the next article, let’s look at the impact of the decision on financial markets and what you can expect from the ECB’s December meeting.