How to Beat Inflation?

We see inflation-linked bonds such as US Treasury Inflation-Protected Securities (TIPS) as a valuable hedge against inflation. We also like inflation-linked debt in the Eurozone and Japan as a potential substitute for nominal bonds. Market Realist: inflation-linked bonds could turn out to be a better choice Inflation-linked bonds (TIP) provide a hedge against inflation by […]

Dec. 11 2019, Updated 12:47 p.m. ET

We see inflation-linked bonds such as US Treasury Inflation-Protected Securities (TIPS) as a valuable hedge against inflation. We also like inflation-linked debt in the Eurozone and Japan as a potential substitute for nominal bonds.

Market Realist: inflation-linked bonds could turn out to be a better choice

Inflation-linked bonds (TIP) provide a hedge against inflation by providing the higher return than inflation index. They are natural asset class to investors wary of the sudden rise in inflation or to those with inflation-linked liabilities like pension funds, charities, and endowments.

Rising inflation expectations

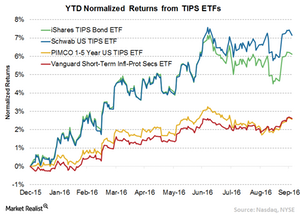

The sale of inflation-linked bonds (STIP) (SCHP) in the US is likely to get a further boost as the country is gradually inching towards the target inflation rate of 2% set by the Federal Reserve. In recent times, the US has seen a steady build-up of inflation due to the rising cost of health care and homes. The latest data shows that prices rose 0.2% in August after remaining unchanged in July.

The core CPI (consumer price index), which excludes food and energy costs, rose 0.3% in August—the biggest increase since February, after gaining 0.1% in July. The core CPI increased 2.3% in August year-over-year after rising 2.2% in July.

Consequently, Treasury Inflation-Protected Securities, or TIPs, are likely to see increased demand from investors concerned over rising inflation and attracted to their competitive pricing compared to nominal treasury bonds (AGG).

BOJ and ECB are in the same boat

The Bank of Japan and the European Central Bank are following the policy of quantitative easing to boost inflation and spur economic growth. Buoyed by monetary measures, many economists believe a pick-up in inflation in Japan and EU next year. In such circumstances, inflation-linked bonds (ITIP) could be a better choice for investors to stay a step ahead of inflation.