How Delayed Monetary Accommodation Can Cause a Recession

Retracting monetary accommodation on time is crucial as well. This was the chief reason why three dissents took place in the September FOMC.

Oct. 18 2016, Updated 5:04 p.m. ET

Delayed retraction of monetary accommodation

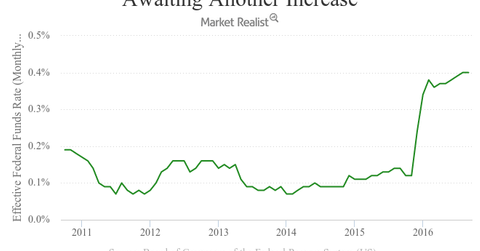

Monetary stimulus is used to resuscitate the economy and assist in stoking inflation. Retracting monetary accommodation on time is crucial as well. This was the chief reason why three dissents took place in the September FOMC (Federal Open Market Committee) meeting.

Dissenters said that if monetary accommodation is not removed gradually, then it will push down the unemployment rate to below the long-term consensus forecasts. This would increase wage pressures, leading to a possible surge in consumer spending. While an increase in consumer spending is good news for corporates operating in the space and some ETFs (XLY) (XRT), it will give rise to strong inflationary pressures.

[marketrealist-chart id=1667215]

You must realize that core inflation has maintained its ~1.5% level for the past few months even though overall inflation has remained tepid due to lingering effects of crude oil and import prices. A surge in consumer spending will likely lead to galloping inflation. If this happens, the Federal Reserve will have to respond by hiking interest rates suddenly and sharply.

Not only would this move go against their guideline of gradual increases, but it would also negatively impact their economic activity as it would increase loan rates and curb spending activity. In times of depressed exports and relatively low government spending, a decline in consumer spending could quite possibly tip the economy into recession.

Impact of the rate hike on the yield curve

When a rate hike occurs, the entire yield curve is impacted. The impact on long-duration securities is more than that on short-duration securities. However, the reasons for the impact are different.

Short-term rates rise in response to a hike in the federal funds rate, which is a short-term rate. On the other hand, long-term rates rise in view of a higher inflation expectation because a rate hike is akin to a vote of confidence in the domestic economy by its central bank. A faster growth pace means higher inflation, and long-term securities are quite sensitive to changes in the inflation rate.

A sudden rise in interest rates due to a spurt in inflation damages the fixed income market as investors flee long-term maturities (TLT). Short positions in long-term bonds (TMV) may hurt the market even further. Equities (DIA) would also react quite sharply to a sudden hike in rates.

So a sudden rate hike isn’t good for the economy in general or sentiment in particular, and the Fed would want to keep itself at bay from such a situation.

In the next article, let’s see the expectations for policymakers regarding US GDP growth in 2016 and beyond.