Behind the Fidelity Blue Chip Growth Fund’s Disappointing Performance in 2016

FBGRX has had a below-average 2016 so far, placing seventh in our select peer group of 12 funds in terms of point-to-point returns.

Oct. 24 2016, Updated 5:04 p.m. ET

Performance evaluation: FBGRX

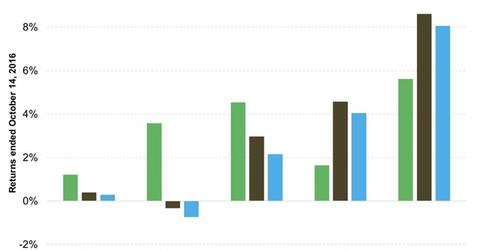

The Fidelity Blue Chip Growth Fund (FBGRX) has had a below-average 2016 so far, placing seventh in our select peer group of 12 funds in terms of point-to-point returns. However, the past six months have been much better for the fund. We have graphed below FBGRX’s performance against two ETFs: the iShares S&P 500 Growth ETF (IVW) and the iShares Russell 1000 Growth ETF (IWF).

Let’s look at what has contributed to this below average YTD (year-to-date) performance by the fund in 2016.

Contribution to returns

Tech stocks have benefitted FBGRX the most YTD in 2016. Facebook (FB) and Apple (AAPL) have pushed the sector’s performance but some gains have been reduced due to a pullback by Fitbit (FIT), among other negatively contributing stocks.

The energy, consumer discretionary, and staples sectors have also contributed to the fund. Continental Resources (CLR), Anadarko Petroleum (APC), and Pioneer Natural Resources (PXD) have also helped the rise in the energy sector.

While Amazon.com (AMZN) and adidas AG (ADDYY) have helped the consumer discretionary sector, consumer staples have been led by Nu Skin Enterprises (NUS). However, the discretionary sector has been held back by Restoration Hardware Holdings (RH), and Associated British Foods has weighed on staples.

The healthcare sector has been the chief cause of worry for FBGRX in 2016. Allergan (AGN) has hobbled the sector, along with Gilead Sciences (GILD) and Regeneron Pharmaceuticals (REGN). GILD has been liquidated from the portfolio, however. Hardly any pick has worked. Only Intuitive Surgical (ISRG) has made a small positive contribution.

The performance of industrials and materials has also hurt the fund. SolarCity (SCTY) has led the laggards in the industrials sector, along with Boeing (BA) and Delta Air Lines (DAL). Dycom Industries (DY) has made a small positive contribution. Meanwhile, CF Industries Holdings (CF) is primarily responsible for driving down materials.

Investor takeaway

Except for the tech and consumer discretionary sectors, the fund’s stock picks from other sectors have been quite disappointing. Even among positively contributing sectors like energy and staples, the fund has lagged behind the stocks in the SPDR S&P 500 ETF (SPY). Healthcare, industrials, and materials have been a drag on the fund.

Investors should thus become wary of this performance. Although investing in mutual funds should be for the medium to long-term, FBGRX’s performance merits a careful review of one’s allocation to it.

In the next part, we’ll look at the historical portfolios of the Fidelity Growth Company Fund (FDGRX).