Can Novo Nordisk Continue to Maintain Market Share in Modern Insulin?

Despite strong competition from new generation insulin therapies, Novo Nordisk (NVO) has managed to maintain its market share in the modern insulin market.

Oct. 3 2016, Updated 8:04 a.m. ET

Modern insulin portfolio

Despite strong competition from new generation insulin therapies, Novo Nordisk (NVO) has managed to maintain its market share in the modern insulin market. The increased use of improved devices has proven beneficial in boosting demand for modern insulin drugs in 2016.

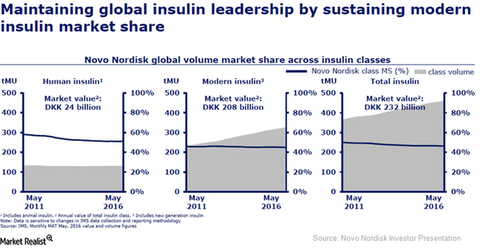

The diagram below shows how Novo Nordisk continues to be a market leader across human insulin and modern insulin classes. While the company’s market share in the human insulin segment dropped significantly from May 2011 to May 2016, NVO’s share in modern insulin has declined to a much smaller extent.

The dominance in the modern insulin segment is a key factor enabling Novo Nordisk to pose strong competition to other diabetes players such as GlaxoSmithKline (GSK), Sanofi (SNY), and Eli Lilly (LLY). To know more about the pressures faced by Novo Nordisk’s modern insulin portfolio, please refer to “Will Novo’s Modern Insulin Portfolio Fall Soon?“

Growth forecasts

Wall Street analysts have projected that Novo Nordisk’s leading modern insulin drug, Levemir, will earn revenues worth ~18.4 billion Danish kroner in 2016, which would represent a YoY (year-over-year) rise of about 0.42%. Levemir revenues are expected to fall to 17.3 billion kroner in 2017. Demand for Levemir continues to suffer due to the cannibalization effect from patients choosing the recently launched basal insulin drug, Tresiba.

Wall Street analysts have estimated that revenues from NovoRapid-Novolog in 2016 will be ~20.3 billion kroner, which would represent a YoY fall of 1.8%. The NovoMix-Novolog mix is also expected to witness YoY revenue fall of about 2.9% and earn only about 10.8 billion kroner in 2016. The fall in revenues is mainly attributed to the company’s loss of a significant contract related to these drugs in 2016.

Although NVO’s modern insulin portfolio may suffer marginally due to the launch of newer and better insulin therapies by Novo Nordisk, the company expects that this will prove to be a beneficial strategy in the long run. If this projection proves correct, it could boost the company’s share price as well as the First Trust Value Line Dividend Index Fund (FVD), which has about 0.49% of its total portfolio holdings in NVO.

Now let’s take a look at Novo Nordisk’s investigational drugs.