Wendy’s Stock Fell Due to Declining Sales

Wendy’s (WEN) posted its 2Q16 results on August 10, 2016. The company posted adjusted EPS (earnings per share) of $0.11 on revenue of $382.7 million.

Aug. 12 2016, Published 11:45 a.m. ET

Wendy’s 2Q16 performance

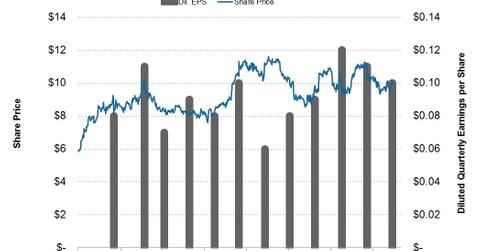

Wendy’s (WEN)—based in Dublin, Ohio—posted its 2Q16 results on August 10, 2016. The company posted adjusted EPS (earnings per share) of $0.11 on revenue of $382.7 million. Compared to 2Q15, the revenue fell by 21.8%, while the EPS grew by 25%.

Analysts were expecting the revenue at $367 million and EPS at $0.09. Although the company beat analysts’ estimates, the decline in its same-store sales growth made investors skeptical about its future earnings. Analysts expected systemwide same-store sales growth of 2.1%—Wendy’s posted same-store sales growth of 0.3%. Along with weakness in the broader equity market, this led to a decline in Wendy’s share price. Wendy’s closed August 10, 2016, at $9.9—a decline of 2.8% from its closing price the previous day.

YTD performance

In fiscal 2015, Wendy’s returned 19.3%. However, YTD (year-to-date), the share price fell by 7.7%. During the same period, Wendy’s peers such as Restaurant Brands International (QSR) and Jack in the Box (JACK) have returned 26.9% and 29.2%, respectively.

Series overview

In this series, we’ll discuss Wendy’s 2Q16 earnings call and notes along with its key performance metrics during the quarter. We’ll also cover the company’s guidance and analysts’ estimates for 3016 and beyond.

Let’s start by seeing why Wendy’s revenue fell in 2Q16.