How Did Visteon’s 2Q16 Earnings Turn Out?

Visteon (VC) rose by 3.1% to close at $70.09 per share during the fourth week of July 2016.

Aug. 1 2016, Published 3:52 p.m. ET

Price movement

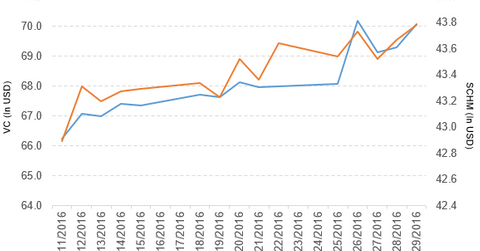

Visteon (VC) rose by 3.1% to close at $70.09 per share during the fourth week of July 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 3.1%, 5.2%, and -38.8%, respectively, as of July 29. VC is trading 4.5% above its 20-day moving average, 0.17% below its 50-day moving average, and 18.8% below its 200-day moving average.

Related ETFs and peers

The Schwab US Mid-Cap ETF (SCHM) invests 0.10% of its holdings in Visteon. The ETF tracks a market-cap-weighted index of mid-cap stocks in the Dow Jones US Total Stock Market Index. The YTD price movement of SCHM was 10.0% on July 29.

The iShares Dow Jones US ETF (IYY) invests 0.01% of its holdings in Visteon. The ETF tracks a broad, cap-weighted index of US companies covering 95% of the US market.

The market caps of Visteon’s competitors are as follows:

Performance of Visteon in 2Q16

Visteon reported 2Q16 sales of $773.0 million, a fall of 4.8% from the sales of $812.0 million in 2Q15. The company’s gross profit margin rose by 15.7% between 2Q15 and 2Q16.

Its net income and EPS (earnings per share) fell to $26.0 million and $0.76, respectively, in 2Q16, compared with $2.2 billion and $49.73, respectively, in 2Q15. It reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) and adjusted EPS of $77.0 million and $1.22, respectively, in 2Q16, a rise of 28.3% and 221.1% from 2Q15.

VC’s cash and equivalents and trade receivables fell by 69.0% and 3.8%, respectively, between 4Q15 and 2Q16. Its current ratio rose to 2.0x and its debt-to-equity ratio fell to 2.1x in 2Q16, compared with 1.5x and 2.9x, respectively, in 4Q15. It reported adjusted free cash flow of $79 in 2Q16, a rise of 139.4% over 2Q15.

Projections

The company has made the following projections for fiscal 2016:

- sales for the Electronics Product Group in the range of $3.1 billion to $3.2 billion

- adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) for the Electronics Product Group in the range of $305 million to $335 million

- adjusted free cash flow for the Electronics Product Group in the range of $110 million to $150 million

In the next part, we’ll look at GoPro.