Why Investors Are Upbeat about Emerging Markets

The sharp rise in global liquidity conditions has been channeled mainly into emerging market (EEM) economies.

Aug. 31 2016, Updated 3:04 p.m. ET

EM equity exchange-traded and mutual funds have attracted $26 billion of inflows since February, reversing a fraction of the roughly $150 billion that had exited the asset class since the 2013 taper tantrum, EPFR Global data show. We see room for further inflows. Asian investors are already rotating into equities, as local bond yields have dropped to new lows under the stampede of a yield-hungry horde. EM equities are trading at a 24% discount to global developed markets on forward earnings multiples, according to Bloomberg data. Fundamentals could further improve, we believe, as EM companies focus on controlling expenses and targeting profits over market share gains.

Market Realist – Emerging markets are trading at a discount to their developed market peers

The sharp rise in global liquidity conditions has been channeled mainly into emerging market (EEM) economies. Investors are pouring money into emerging market funds amid low returns in the developed world. According to data from EPFR, emerging market (EEMV) (AAXJ) equity funds witnessed inflows of $20 billion over the seven weeks ended August 17.

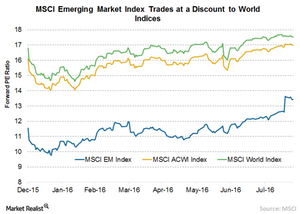

As discussed in the previous section, the higher liquidity has led to a surge in asset prices in emerging markets (IEMG). The MSCI Emerging Market Index is up more than 30% since its low in January this year. Despite the sharp rally, the markets are still trading at a reasonable valuation compared to developed markets.

Attractive valuation

The MSCI Emerging Market Index is trading at a forward PE (price-to-earnings) multiple of 13.4x compared to 17x for the MSCI ACWI Index, a discount of 21%. On the other hand, the MSCI World Index is trading at a forward PE multiple of 17.5x, a premium of 23.6% to the EM index. The MSCI ACWI captures large-cap and mid-cap stocks across 23 developed markets and 23 emerging markets, while the MSCI World Index captures stocks across 23 developed markets. Even on a PBV (price-to-book value) basis, the emerging markets are trading at a lower multiple of 1.47x, a discount of 26% and 29% to the MSCI ACWI and MSCI World Index, respectively.

Higher earnings growth

The trailing earnings growth of the constituents of the MSCI Emerging Markets Index has been falling for the last eight quarters. However, the trend has reversed, and the forward earnings growth inched up 1% in July. The earnings rise is a positive sign for the emerging markets (ILF).