Investor Sentiment Favors Peru, Chile, and Brazil

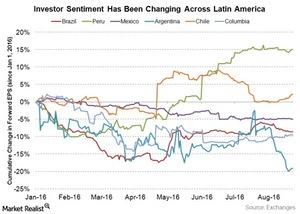

Investor sentiment with respect to Latin American economies has definitely been changing since the beginning of the year.

Nov. 20 2020, Updated 2:31 p.m. ET

Where in Latin America does investing look promising?

For current and prospective investors in Latin America (ILF), it’s important to understand which economies are doing well, which spell trouble, and which could get you attractive returns in this low-yielding environment.

Let’s take a quick glance at the forward earnings per share of major Latin American economies, according to the graph below.

Investor sentiment is tilted toward Brazil and Peru

Investor sentiment with respect to Latin American economies has definitely been changing since the beginning of the year. Forward earnings, which are a good gauge of expected earnings potential, seem to currently be in favor of Peru (EPU), Chile (ECH), and Brazil (EWZ). Earnings potential of companies in these economies seem to reflect an upward trend, while Mexico (EWW), Argentina (ARGT), and Colombia (ICOL) continue to slide.

Let’s also take a look at prices in these economies.

Mexico is expensive: Brazil, Chile, and Peru offer value

As you can see in the above graph, valuations clearly suggest that Mexico is expensive, while Brazil, Chile, and Peru are currently at attractive prices. Columbia’s PE (price-to-earnings) valuations seem to be the lowest among the Latin American economies, but its weak earnings potential doesn’t build a case strong enough for the economy.

Columbia currently has the largest account deficit in Latin America. It borders Venezuela, which is already on the brink of bankruptcy. The huge dependence of the economy’s prospects on crude oil prices further weakens the case for Columbia to be an appropriate investment destination in the near future. Crude oil makes up 45% of Columbia’s export revenue.

One may think the oil dependence issue applies to Brazil as well. However, Brazil definitely holds a worthier promise for investors right now. Let’s take a closer look at Brazil.