Interest Rate Sensitivity: JPMorgan Chase versus Wells Fargo

For Wells Fargo, net interest income makes up 53% of its total income while for JPMorgan Chase (JPM), net interest income makes up 46% of its total income.

Aug. 25 2016, Updated 8:04 a.m. ET

Interest rate sensitivity

Wells Fargo’s (WFC) net interest margin could rise by 5 to 15 basis points if the yield curve shifted upward by 100 basis points. For JPMorgan Chase (JPM), a net change in interest rates of 100 basis points could lead to a $3 billion increase in net interest income.

Wells Fargo forecasts a 1%–3% decline in its earnings if interest rates remain lower for the next two years.

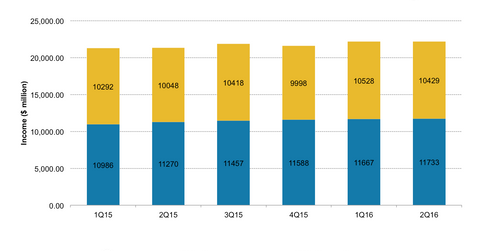

For Wells Fargo, net interest income makes up 53% of its total income while for JPMorgan Chase (JPM), net interest income makes up 46% of its total income.

Notably, Wells Fargo (WFC) and JPMorgan Chase hold the largest loan portfolios in the financial sector (XLF). In 2Q16, JPMorgan Chase had a loan portfolio worth $872 billion.

In comparison, Wells Fargo had a loan portfolio of $951 billion, while Bank of America and Citigroup (C) had loan portfolios of $903 billion and $592 billion, respectively.

Wells Fargo and JPMorgan are not alone in their struggles to boost earnings without a boost from higher rates. Its decline in profits, despite loan growth, is similar to that of peers that have reported second quarter results, including Bank of America (BAC) and Citigroup (C).

In June, Great Britain voted to exit the European Union. This was followed by volatility in financial markets and has led to the IMF cutting its growth forecasts for the global economy. These factors have led to a deterioration in the outlook for future interest rate hikes. Therefore, interest rates will likely be lower for longer. This translates to squeezed net interest margins for banks.

Higher interest rates lead to higher net interest income for banks, resulting in higher profitability margins. However, the Fed has retreated from its expected interest rate hikes, which led to further margin pressures.