Energizer Holdings Declared a Dividend of $0.25 Per Share

Energizer Holdings (ENR) has a market cap of $3.2 billion. It rose by 0.78% to close at $51.93 per share on August 1, 2016.

Aug. 2 2016, Published 2:33 p.m. ET

Price movement

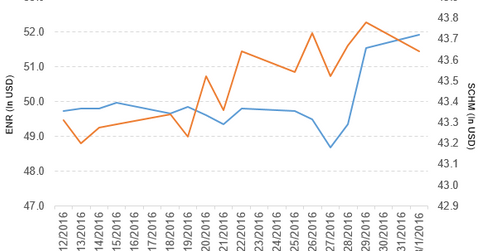

Energizer Holdings (ENR) has a market cap of $3.2 billion. It rose by 0.78% to close at $51.93 per share on August 1, 2016.

The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.4%, 0.85%, and 54.3%, respectively, on the same day. ENR is trading 3.5% above its 20-day moving average, 5.9% above its 50-day moving average, and 27.1% above its 200-day moving average.

Related ETFs and peers

The Schwab US Mid-Cap ETF (SCHM) invests 0.32% of its holdings in Energizer. The ETF tracks a market cap–weighted index of mid-cap stocks in the Dow Jones US Total Stock Market Index. The YTD price movement of SCHM was 9.7% on August 1.

The SPDR S&P 400 Mid-Cap Value ETF (MDYV) invests 0.20% of its holdings in Energizer. The ETF tracks a market cap–weighted index of US stocks. The index uses three factors to select value stocks from the 400 stocks chosen by the S&P Committee.

The market caps of Energizer’s competitors are as follows:

Energizer declared a dividend

Energizer Holdings has declared a quarterly dividend of $0.25 per share on its common stock. The dividend will be paid on September 9, 2016, to shareholders of record at the close of business on August 19, 2016.

The company also plans to increase the quarterly dividend on its common stock by 10% to $0.28 per share starting in 2017.

Performance in 2Q16

Energizer Holdings reported 2Q16 net sales of $334.0 million, a fall of 6.4% compared to net sales of $3.6 billion in 2Q15. Sales of its North America, Latin America, EMEA (Europe, the Middle East, and Africa), and Asia-Pacific segments fell by 0.47%, 22.8%, 3.7%, and 15.5%, respectively, in 2Q16, compared to the same period last year.

Energizer Holdings’ net income and EPS (earnings per share) rose to $16.4 million and $0.26, respectively, in 2Q16, compared to -$69.2 million and -$1.11, respectively, in 2Q15.

Energizer’s cash and cash equivalents rose by 14.8% in 2Q16. Its inventories fell by 21.0% in 2Q16 compared to 4Q15. Its current ratio rose to 2.6x in 2Q16, compared to 2.3x in 4Q15.

Projections

Energizer Holdings has made the following projections for 2016:

- net sales to fall in the low single digits

- organic net sales to rise in the low single digits

- $60 million–$70 million negative impact on net sales from foreign currency movements

- international go-to-market changes to reduce net sales in the low single digits

- deconsolidation of Venezuela results to reduce net sales by $8.5 million

- gross margin rates to fall by 2.5% due to unfavorable currency impacts, international go-to-market changes, the impact of the Venezuela deconsolidation, and investments in product improvements and productivity initiatives

- an income tax rate of 29%–30%

- adjusted earnings before interest, tax, depreciation, and amortization of $280 million–$300 million

- free cash flow exceeding $150 million

- spin and restructuring costs of $15 million–$20 million

In the next part, we’ll take a look at Kimberly-Clark (KMB).