How Did Delphi Automotive Perform in 2Q16?

Delphi Automotive (DLPH) has a market cap of $17.5 billion. It fell by 1.9% to close at $64.05 per share on August 3, 2016.

Aug. 4 2016, Published 4:10 p.m. ET

Price movement

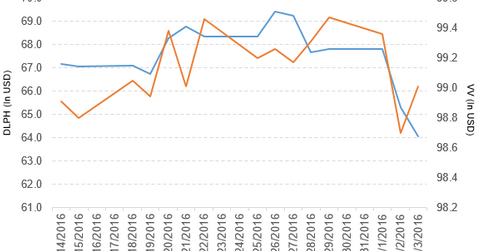

Delphi Automotive (DLPH) has a market cap of $17.5 billion. It fell by 1.9% to close at $64.05 per share on August 3, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -7.5%, 6.4%, and -24.6%, respectively, on the same day. DLPH is trading 4.2% below its 20-day moving average, 3.7% below its 50-day moving average, and 11.7% below its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.09% of its holdings in Delphi Automotive. The ETF tracks a market-cap-weighted index that covers 85% of the market capitalization of the US equity market. The YTD price movement of VV was 6.9% on August 3.

The market caps of Delphi Automotive’s competitors are as follows:

Performance of Delphi Automotive in 2Q16

Delphi Automotive reported 2Q16 net sales of $4.2 billion, a rise of 7.7% from the net sales of $3.9 billion in 2Q15. Sales of the electrical and electronic architecture and electronics and safety segments rose by 15.1% and 9.0%, respectively, and sales of the powertrain systems segment fell by 2.2% between 2Q15 and 2Q16. It reported a restructuring expense of $154.0 million in 2Q16, compared with $17.0 million in 2Q15. The company’s cost of sales as a percentage of net sales and operating income fell by 1.2% and 18.7%, respectively.

Its net income and EPS (earnings per share) fell to $258.0 million and $0.94, respectively, in 2Q16, compared with $645.0 million and $2.23 in 2Q15. It reported adjusted EPS of $1.59 in 2Q16, a rise of 18.7% from 2Q15.

Delphi’s cash and cash equivalents fell by 18.3% and its inventories rose by 11.6% between 4Q15 and 2Q16. Its debt-to-equity ratio fell to 3.3x in 2Q16 from 3.4x in 4Q15. It reported a current ratio of 1.3x in 4Q15 and 2Q16. During 2Q16, the company repurchased 0.89 million shares worth ~$65 million. Currently, it has ~$1.6 billion for future share repurchases.

Quarterly dividend

Delphi Automotive has declared a quarterly cash dividend of $0.29 per share on its common stock. The dividend will be paid on August 24, 2016, to shareholders of record at the close of business on August 10, 2016.

Projections

The company has made the following projections for fiscal 3Q16 and fiscal 2016:

Fiscal 3Q16

- revenue in the range of $3.9 billion to $4.0 billion

- adjusted operating income in the range of $505 million to $525 million

- adjusted EPS in the range of $1.38 to $1.44

- adjusted effective tax rate of 17%

Fiscal 2016

- revenue in the range of $16.3 billion to $16.5 billion

- adjusted operating income in the range of $2.15 billion to $2.20 billion

- adjusted EPS in the range of $5.95 to $6.05

- cash flow from operations of $1.9 billion

- capital expenditures in the range of $750 million to $800 million

- adjusted effective tax rate of 17%

Next, we’ll discuss the performance of Kate Spade & Company in 2Q16.