Category Flows: Looking for Yield? Be Picky!

The rise of the actively selective investor becomes more nuanced within the context of our entire ETF universe.

Aug. 1 2016, Published 9:18 a.m. ET

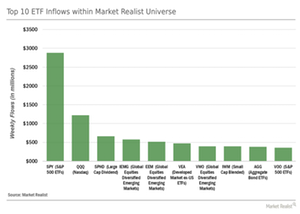

Inflows: Tech, EEM, and dividends

The rise of the actively selective investor becomes more nuanced within the context of our entire ETF universe. Last week, it was all about a more selective hunt for yield. Looking past SPDR’s S&P 500 ETF Trust (SPY)—which often tops the inflow list since it’s the largest ETF by assets under management—we saw that market participants continued hunting for yield in US technology, emerging markets, and dividend plays.

Dividends and low volatility

Last week‘s standout was arguably PowerShares’ S&P 500 High Dividend Low Volatility Portfolio (SPHD). The ETF attracted ~$660 million of capital—its largest weekly inflow in 2016. But why did we see these significant capital inflows only last week? After all, SPHD posted five consecutive weeks of positive returns and closed at an all-time high on Friday.

As we discussed in Part 1 and Part 2 of this series, investors have become increasingly anxious about the lofty levels that many US index and GICS sector ETFs are trading at. Yet portfolio managers still need to find return opportunities. SPHD offers one solution to this dilemma: exposure to 50 stocks with muted volatility in combination with high yield picked from the S&P 500. You can see the additional low-volatility component in SPHD’s five-year beta to SPY of ~0.7. This level is much lower than pure divided-yield ETFs such as the WisdomTree Total Dividend Fund (DTD).

Aside from SPHD, we also noted that the tech-focused PowerShares QQQ Trust (QQQ), which we highlighted in Part 1 of this series, took the second spot in terms of inflows in our entire ETF universe. This ranking makes the rotation into the year-to-date underperformer all the more significant. Outside the United States, emerging markets remain the yield play of choice as cash continues to flow into the iShares Core MSCI Emerging Markets ETF (IEMG) and the iShares MSCI Emerging Markets ETF (EEM). Both IEMG and EEM now rank among the top ten ETFs in terms of inflows on a year-to-date basis.

Outflows: Capital rushes out of high-yield ETFs

As capital flowed into more nuanced yield plays—including the high-yield, low-volatility ETF (SPHD)—investors took money out of the recently popular high yield bond space.

As you can see in the chart above, a whopping ~$940 million left the iShares iBoxx $ High Yield Corporate Bond ETF (HYG). These outflows go hand in hand with the ETF’s ~0.9% weekly pull-back—its first weekly loss after five consecutive weeks of gains. Similarly, the SPDR Barclays High Yield Bond ETF (JNK) witnessed outflows of ~$450 million while declining ~0.8%.

What do these changes this tell us? Both ETFs reached year-to-date highs in July as investors were willing to accept the risks associated with high-yield debt in return for yield that most government bonds simply couldn’t deliver. However, given that capital flowed into less-risky yield opportunities—including the aforementioned low-volatility, high-yield SPHD—it seems risk tolerance somewhat receded.

In the context of our larger theme of actively selective investor behavior, note that the rotation out of HYG and JNK into SPHD provides yet another example of a more selective hunt for yield opportunities.

Let’s turn our attention to the country ETF space in the next part of our series.