Richard Bernstein: Falling Yields Are Testimony to Risk Aversion

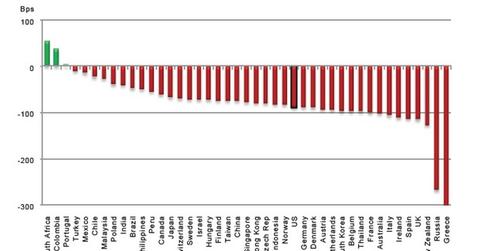

Bernstein asked a rhetorical question: “Could there be anything that suggests extreme risk aversion more than the increasing proportion of global sovereign bonds that have negative yields?”

Nov. 20 2020, Updated 10:56 a.m. ET

Seeking shelter in bonds

Earlier in this series, we talked about investors seeking shelter in bonds, among a few other asset classes, in times of high volatility or distress. In the previous article, we looked at proof provided by Richard Bernstein pertaining to equity markets that investors are currently being risk-averse and not bullish. That’s a viewpoint that’s not seconded by many. In this part of the series, we’ll look at signals from the bond market.

When investors flock to bonds (VCSH) (SCPB), their demand rises. This is reflected in bond prices, which rise as a result of high demand. There’s an inverse relationship between bond prices and their yields. So as prices rise, yields fall. A look at bond yields can thus be reflective of the risk-averse attitude of investors.

To that extent, Bernstein, in his Insights newsletter for July, asks a rhetorical question: “Could there be anything that suggests extreme risk aversion more than the increasing proportion of global sovereign bonds that have negative yields?”

Negative yields prevalent

Several developed countries, including Germany (EWG) and Japan (EWJ), have witnessed negative yields on sovereign bonds. Yields were beaten down recently after Britain voted itself out of the European Union, affecting countries around the world.

Investing in a negative-yielding bond is indicative of extreme risk-averse behavior. If investors were aware of or believed in investment avenues that could provide positive returns, they wouldn’t invest in negative-yielding bonds.

Bernstein said, “If investors were overly bullish toward equities, we doubt that bonds would carry negative yields.” In fact, investors who are bullish toward equities (SPHD) would dump bonds, resulting in high yields.

It’s important to note that banks and financial institutions are sometimes mandated to be invested in sovereign bonds due to statutory requirements, regardless of their yield level. However, even after considering this, the negative level of bond yields seems a bit much.

Bernstein said that investors are being risk-averse due to profits recession. Let’s look at his views on this in the next part of the series.