What Is Demand-Pull and Cost-Push Inflation?

Both Russia (RSX) and Brazil (EWZ) are experiencing cost-push inflation. Both economies are highly dependent on commodities.

Jul. 25 2016, Published 10:07 a.m. ET

“Demand-Pull” Inflation

In general, economies are expected to grow—not stay the same or slow down. A growing economy (possibly caused by low interest rates) can cause inflation, as consumers in these economies typically feel confident about the future and spend more money. Sellers anticipate this demand and raise prices, creating inflation. This is also known as “demand-pull” inflation. When supply is not keeping up with demand, prices can become even higher. If consumers expect further inflation in the future, they may make purchases sooner in order to avoid higher prices down the road, which in turn benefits economic growth.

“Cost-Push” Inflation

In contrast, inflation can occur even without economic growth. An increase in the cost of business can cause inflation as well. If manufacturers slow output while demand remains the same, then prices will go up as a result of basic supply and demand principles. Manufacturers could slow down due to higher wages, new taxes or an increase in the cost of exports (foreign exchange or FX cost). This is known as “cost-push” inflation.

What is demand-pull and cost-push inflation? Market Realist’s View

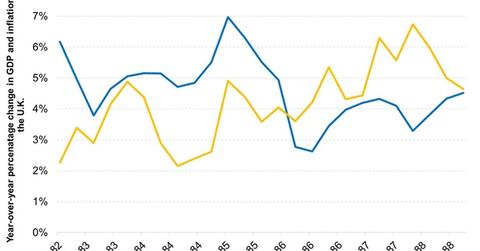

The graph above shows the inflation rate and GDP growth rate in the United Kingdom. In the 1980s, the United Kingdom (EWU) experienced rapid economic growth. The government cut rates as well as taxes. House prices rose about 30%, which fueled a positive wealth effect. Consumer confidence soared.

This led to higher spending, lower saving, and increased borrowing. The rate of economic growth reached 5% per year, which is much higher than the United Kingdom’s long-run trend rate of 2.5%. This led to a rise in inflation since companies couldn’t catch up with demand.

Currently, there are very few examples of demand-pull inflation, given the slowing global (URTH) economy.

Both Russia (RSX) and Brazil (EWZ) are experiencing cost-push inflation. Both economies are highly dependent on commodities. A slump in commodity prices has led to a recession in their economies and a massive depreciation in their currencies. Weaker currencies lead to an increase in cost of imports.

The second graph shows Brazilian reals per one US dollar along with inflation rates in Brazil. Since the start of 2015, the real has depreciated by ~24% and by a staggering ~55% since 2011. This has caused a massive increase in export prices, which has caused inflation to rise.