Can Productivity Measures Help Coca-Cola’s Margins in 2Q16?

Coca-Cola’s (KO) margins contracted in 1Q16 due to the impact of adverse currency fluctuations and structural headwinds.

Jul. 25 2016, Updated 9:07 a.m. ET

Margins under pressure

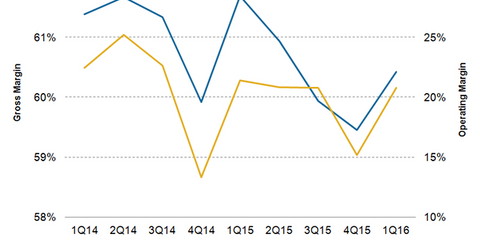

Coca-Cola’s (KO) margins contracted in 1Q16 due to the impact of adverse currency fluctuations and structural headwinds. The company’s gross margin declined to 60.4% in 1Q16 from 61.7% in 1Q15. This decline was caused by currency headwinds, refranchising of the company’s North American bottling operations, and the sale of Coca-Cola’s legacy energy brands to Monster Beverage (MNST).

Operating margin in 1Q16

Coca-Cola’s operating margin declined to 20.8% in 1Q16 from 21.4% in 1Q15. This was due to the same unfavorable factors that impacted the company’s gross margins. These unfavorable factors offset the positive impact of productivity initiatives, the favorable timing of certain expenses, and segment mix.

PepsiCo (PEP), Dr Pepper Snapple (DPS), and Monster Beverage (MNST) delivered operating margins of 13.6%, 21%, and 37.4% respectively, in 1Q16. PepsiCo, which announced its 2Q16 results on July 7, 2016, reported an operating margin of 19.3% in 2Q16, up from 18.2% in 2Q15. This improvement was a result of the company’s revenue management strategies and productivity gains.

The iShares Global Consumer Staples ETF (KXI) has 5% exposure to Coca-Cola.

Productivity initiatives

Coca-Cola and its peers are implementing several productivity initiatives to mitigate the impact of a volatile macro environment and softness in soda volumes. Its productivity initiatives involve the restructuring of its global supply chain, implementation of zero-based budgeting, and streamlining and simplifying the company’s operating model. It’s also working to increase discipline and efficiency in its direct marketing investments.

Coca-Cola expects to generate more than $600 million in productivity savings in fiscal 2016. The company aims to generate total annualized productivity savings of about $3.6 billion by 2019. It would redirect these productivity savings to marketing efforts and innovation to boost revenue.

We’ll look at analysts’ expectations for Coca-Cola’s 2Q16 earnings in the next part of the series.