Campbell Soup’s Efforts to Make GMO Labeling Mandatory

Campbell Soup Company (CPB) has a market cap of $20.9 billion. Its stock rose by 1.7% to close at $67.19 per share on July 5, 2016.

Nov. 20 2020, Updated 12:46 p.m. ET

Campbell Soup’s price movement

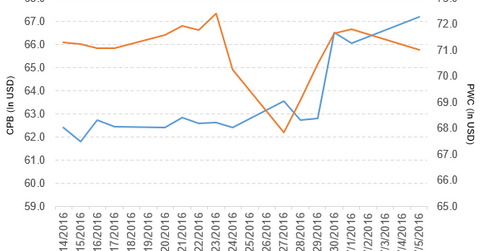

Campbell Soup Company (CPB) has a market cap of $20.9 billion. Its stock rose by 1.7% to close at $67.19 per share on July 5, 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 5.7%, 8.9%, and 29.3%, respectively, on the same day. CPB is trading 7.0% above its 20-day moving average, 7.3% above its 50-day moving average, and 18.0% above its 200-day moving average.

Related ETFs and peers

The PowerShares Dynamic Market Portfolio (PWC) invests 0.55% of its holdings in Campbell Soup. The ETF tracks a quant-selected, tier-weighted index covering the entire US equity market. The YTD price movement of PWC was -2.3% on July 5.

The iShares Russell Mid-Cap Value ETF (IWS) invests 0.12% of its holdings in Campbell Soup. The ETF tracks an index of US mid-cap value stocks. The index selects from the bottom 80% of the Russell 1000, screening on value factors.

The market caps of Campbell Soup’s competitors are as follows:

Latest news on Campbell Soup

In a press release on July 5, 2016, Campbell Soup stated the following: “Campbell Soup Company (CPB) today urged Congress and the president to enact bipartisan legislation proposed by the US Senate that directs the US Department of Agriculture (USDA) to craft a national mandatory disclosure system for foods made with genetically modified organisms (GMOs) as soon as possible.”

The company also noted, “Campbell applauds Senators Pat Roberts (R-KS) and Debbie Stabenow (D-MI) for their proposal to help consumers more easily access information about GMOs in foods. The bill paves the way for a single national standard with multiple options for disclosure. Campbell remains committed to printing clear and simple language on the labels of all of its US products.”

Campbell Soup added, “The company is in discussions with the USDA and the Food and Drug Administration about its plans to develop on-pack language that is easy for consumers to understand and clearly identifies the presence of ingredients derived from GMO crops.”

Campbell Soup’s performance in fiscal 3Q16

Campbell Soup reported fiscal 3Q16 total sales of $1,870.0 million, a fall of 1.6% compared to total sales of $1,900.0 million in fiscal 3Q15. Sales from Americas Simple Meals and Beverages and Global Biscuits and Snacks fell by 3.0% and 2.4%, respectively, and sales from Campbell Fresh rose by 6.5% in fiscal 3Q16 compared to fiscal 3Q15.

The company’s net income and EPS (earnings per share) rose to $185.0 million and $0.59, respectively, in fiscal 3Q16, compared to $179.0 million and $0.57, respectively, in fiscal 3Q15. It reported adjusted EPS of $0.65, a fall of 1.5% compared to fiscal 3Q15.

Campbell Soup’s cash and cash equivalents rose by 66.5% in fiscal 3Q16 compared to fiscal 3Q15. Its current ratio rose to 0.86x, and its debt-to-equity ratio fell to 2.2x in fiscal 3Q16, compared to a current ratio and a debt-to-equity ratio of 0.82x and 2.4x, respectively, in fiscal 3Q15.

Quarterly dividend

Campbell Soup has declared a regular quarterly dividend of $0.31 per share on its common stock. The dividend will be paid on August 1, 2016, to shareholders of record at the close of business on July 11, 2016.

Projections

The company has made the following projections for fiscal 2016:

- net sales growth in the range of -1%–0%

- adjusted EBIT (earnings before interest and tax) growth in the range of 11%–13%

- adjusted EPS in the range of $2.93–$3.00

This guidance includes a 2% negative impact from currency translation and from the Garden Fresh Gourmet acquisition.

In the next part of this series, we’ll look at why PepsiCo’s stock rose on July 5. .