Buckingham Research Downgrades Packaging Corporation of America to ‘Neutral’

Its net income and EPS (earnings per share) rose to $102.6 million and $1.09, respectively, in 1Q16, as compared to $89.6 million and $0.92, respectively, in 1Q15.

Jul. 19 2016, Published 4:57 p.m. ET

Price movement

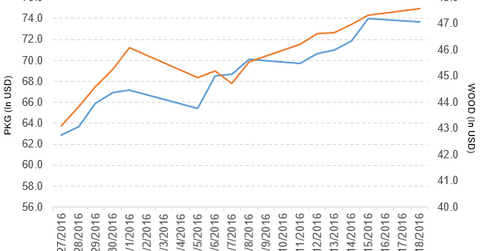

Packaging Corporation of America (PKG) has a market cap of $6.9 billion. It fell by 0.49% to close at $73.67 per share on July 18, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 5.6%, 12.4%, and 19.0%, respectively, on the same day. PKG is trading 8.3% above its 20-day moving average, 9.8% above its 50-day moving average, and 20.4% above its 200-day moving average.

Related ETF and peers

The iShares Global Timber & Forestry ETF (WOOD) invests 3.8% of its holdings in PKG. The ETF tracks the 25 largest publicly listed companies that own or manage forests and timberlands. The YTD price movement of WOOD was -0.40% on July 18.

The market caps of PKG’s competitors are as follows:

PKG’s rating

Buckingham Research has downgraded Packaging Corporation of America’s rating to “neutral” from “buy.” It also set the stock price target at $74.0 from $72.0 per share.

1Q16 results

For 1Q16, Packaging Corporation reported net sales of $1.4 billion, a decline of 1.7% over the $1.4 billion we saw in 1Q15. Sales from PKG’s packaging and paper segments fell by 0.35% and 5.7%, respectively, in 1Q16 over 1Q15.

The company’s cost of sales as a percentage of net sales fell by 2.4%, and its operating income rose by 15.1% YoY in 1Q16.

Its net income and EPS (earnings per share) rose to $102.6 million and $1.09, respectively, in 1Q16, as compared to $89.6 million and $0.92, respectively, in 1Q15. It reported non-GAAP (generally accepted accounting principles) EBITDA (earnings before interest, tax, depreciation, and amortization) of $269.5 million in 1Q16, an increase of 7.6% compared to 1Q15.

Next, we’ll take a look at Nike.