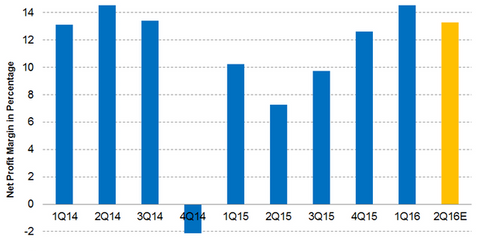

Albemarle: How Much Net Profit Margin Are Analysts Predicting?

As of July 26, 2016, analysts are expecting Albemarle’s (ALB) net profit margin to be about 13.3% in 2Q16. That compares to 7.3% in 2Q15 and 14.5% in 1Q16.

Aug. 1 2016, Updated 9:11 a.m. ET

Net profit margin

As of July 26, 2016, analysts are expecting Albemarle’s (ALB) net profit margin to be about 13.3% in 2Q16. That compares to 7.3% in 2Q15 and 14.5% in 1Q16.

This implies an increase in margins of approximately 6 percentage points on a year-over-year (or YOY) basis and a decrease of 1.2 percentage points in net profit margins on a sequential basis.

Albemarle’s net profit margin has been volatile, but it has been on the rise since 2Q15. Analysts are expecting Albemarle’s peers FMC (FMC) W.R. Grace (GRA), and PPG Industries (PPG) to have net profit margins of 10.2%,11.9%, and 12.7%, respectively.

Albemarle’s net profit margins are higher than its peers since it commands a higher EBITDA (earnings before interest, tax, depreciation, and amortization) margin of 27.7%, which is higher than its peers. Analysts expect Albemarle’s higher EBITDA margin to be driven by the reduction in costs of goods sold, SG&A (selling, general, and administrative) expenses, and R&D (research and development) expenses.

Albemarle’s EPS

Analysts are predicting Albemarle’s 2Q16 adjusted EPS (earnings per share) to be about $1. In 2Q15, its adjusted EPS was $0.84. EPS for 1Q16 was $1.12. This implies an increase of 19% on a year-over-year basis and a decline of 10.7% on a sequential basis. Albemarle has managed to beat analysts’ estimates in the past five quarters.

Expected growth in most of its businesses and continued cost-saving efforts should help the company deliver analysts’ EPS expectations for 2Q16. Albemarle management revised its 2016 EPS to $3.90–$4.25 compared to the earlier guidance of $3.45–$3.80.

As of July 26, 2016, the iShares Russell Mid-Cap Value ETF (IWS) held 0.3% of its total holdings in Albemarle.

In the next part of the series, we’ll look at Albemarle’s capital expenditure, dividends, and share repurchase program.