The Word on the Street: How Analysts See Papa John’s

Analysts are maintaining a price target of $67.6 for Papa John’s for the next 12-months, which represents a return potential of 2.5% for the company.

Jul. 5 2016, Updated 11:06 a.m. ET

Analyst target prices

As of June 28, 2016, Papa John’s (PZZA) was trading at $66. Remember, this share price might have already priced in the estimates that we discussed earlier in this series. In this part, we’ll look at analyst recommendations and estimated price targets for PZZA for the next 12 months.

PZZA’s initiatives to remove all artificial and synthetic ingredients from its menu, in addition to measures such as using of 100% vegetarian poultry feed, appear to have increased investor confidence. This has led to the rise in PZZA’s share price.

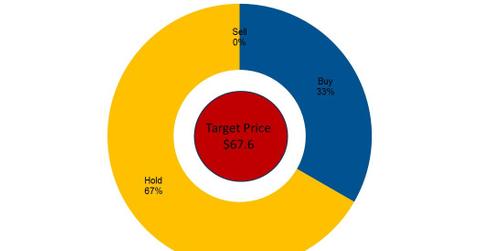

However, analysts are still maintaining a price target of $67.6 for the next 12-months, which represents a return potential of 2.5% for PZZA. On the high side, Peter Saleh from BTIG has estimated that the stock will touch $78, which represents a return potential of 18.2%. On the low side, Mark E. Smith from Feltl & Company forecasts a target price of $58, which represents a fall of 12.1%.

The 12-month targets for Papa John’s peers are as follows:

Analyst recommendations

According to a Bloomberg survey of seven analysts, 33.3% have issued a “buy” recommendation, and 66.7% have a “hold” recommendation for Papa John’s (PZZA).

Remember, Papa John’s share prices move in tandem with analysts’ recommendations. But as analysts raise their target price for the next 12 months, the stock could also increase, and vice versa. Notably, Papa John’s makes up 0.6% of the holdings of the iShares S&P Small-Cap 600 Growth ETF (IJT).

Keep in mind that if a share price is lower than its target price, it doesn’t necessarily mean you should automatically buy the stock. Before investing, you have to carefully analyze the various metrics we’ve covered in this series.