How Did LinkedIn’s Growth and Earnings Quality Look before Deal?

Microsoft (MSFT) announced the acquisition of LinkedIn (LNKD) for $26.2 billion in cash on June 13, 2016.

Jun. 27 2016, Updated 10:13 a.m. ET

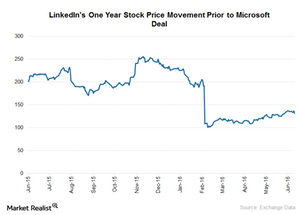

LinkedIn’s stock plunged prior to the deal

Microsoft (MSFT) announced the acquisition of LinkedIn (LNKD) for $26.2 billion in cash on June 13, 2016. In the company’s largest acquisition to date, Microsoft agreed to pay $196 for every LinkedIn share, which reflected a premium of roughly 50% over its closing price on June 10, 2016. The deal, subject to regulatory approval, is expected to benefit Microsoft in a number of ways. However, this series will focus on how the deal is beneficial to LinkedIn.

Prior to the deal announcement, LinkedIn’s share price plummeted 42% in 2016 as can be seen in the chart below. A declining revenue growth rate, a weak outlook, and slow growth in unique visiting members to its platform took a toll on its share price. Moreover, the company’s business segments like the Talent and Marketing solutions have their own challenges, which we’ll discuss in a later part of the series.

LinkedIn’s overdependence on stock-based compensation

LinkedIn continues to report negative earnings on a GAAP (generally accepted accounting principles) basis, primarily reflecting excessive stock-based compensation, which is expected to be ~$580 million in 2016. Last year, the company paid ~$510 million as stock-based compensation, which amounts to ~96% of operating income or about 16% of the company’s revenue. Other companies like Google (GOOG), Amazon (AMZN), and Facebook (FB) pay approximately 15% of operating income, or 10% of revenues, as stock-based compensation.

Most analysts agree that the higher a company’s dependence on stock-based compensation, the lower the quality of its earnings. Thus, being acquired appears to be the best deal for LinkedIn.

For diversified exposure to select software companies in the United States, you could consider investing in the SPDR S&P 500 ETF (SPY). This ETF has 8% exposure to the application software industry.