What Are the Attractive Characteristics of High Yield EM Bonds?

Investors are flocking to government bonds (BND) of developed markets, which is causing downward pressure on interest rates.

Sep. 1 2020, Updated 11:24 a.m. ET

High Yield EM bonds Offer Attractive Characteristics

The high yield EM bonds sector, as measured by the BofA Merrill Lynch Diversified High Yield US Emerging Markets Corporate Plus Index, has grown tremendously in the past 10 years, from a market value of $33 billion in 2006 to approximately $346 billion today. Although emerging markets corporate issuers may issue bonds denominated in local currencies, the vast majority of high yield emerging markets bonds are U.S. dollar denominated (and are the focus here), which significantly reduces the currency risk to U.S. investors.

At the end of May, the sector was yielding 8.42%. That was approximately 1% more than U.S. high yield (7.43%), while also having a lower duration (3.80 versus 4.33), a higher average credit rating, and a historically lower average default rate.

Why Higher Yields?

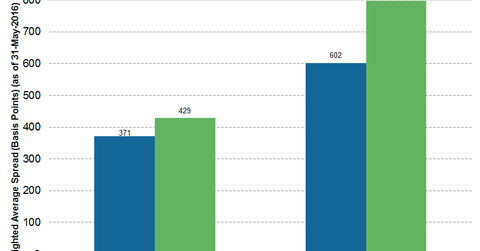

Emerging markets corporate issuers have traditionally had to pay more for financing versus their similarly rated U.S. market counterparts due to the additional risks generally associated with emerging markets investing. For example, the average spread of BB rated emerging markets bonds was 58 basis points higher than those of U.S. bonds falling into the same ratings bucket, as of May 31, 2016. For B rated bonds, that spread differential was nearly 200 basis points.

Market Realist – Most of the developed markets are reeling under negative fixed income yields. With the turmoil caused by the recent Brexit referendum in the UK (EWU), volatility (VXX) in global equities (ACWI) is on the rise. Investors are flocking to government bonds (BND) of developed markets, which is causing downward pressure on interest rates, as bond prices are inversely proportional to yields. In fact, according to Fitch Ratings, the total amount of government bonds with negative yields has gone up from $1.3 trillion in May 2016 to a whopping $11.7 trillion as of June 27, 2016. The report from Fitch Ratings shows that negative yielding long-term government debt with maturities over seven years has gone up from $1.4 trillion in April to $2.6 trillion now (Source: Fitch, WSJ). This can be seen in the graph below.

This may be the perfect time to capitalize on the opportunities provided by high yield EM (emerging markets) bonds (HYEM) (EMHY). Not only do EM bonds offer attractive characteristics, as illustrated above, the higher yields can be a blessing for income-seeking investors, especially in the current global context of negative yields.

We’ll discuss how high yield EM bonds offer hidden value and the composition of the HYEM ETF in the next part of this series.