How Do Casey’s Valuations Stack Up against Its Peers’?

After Casey’s General Stores’ double-digit earnings growth over the last three fiscal years, Wall Street expects a slowdown in its earnings per share growth.

Jun. 13 2016, Updated 9:05 a.m. ET

Growth expectations for fiscal 2016

After Casey’s General Stores’ (CASY) double-digit earnings growth over the last three fiscal years, Wall Street is expecting a slowdown in its earnings per share (or EPS) growth. The average consensus estimate for CASY’s fiscal 2017 EPS stands at $5.8, reflecting a 1% year-over-year (or YoY) rise.

While CASY’s fiscal 1Q17 EPS are forecast to rise by 12% YoY, its fiscal 2Q17 EPS are expected to fall by 14% YoY. Its earnings are likely to gain momentum starting in fiscal 3Q17, rising by 4% YoY. In fiscal 4Q17, its earnings are expected to see a 13% YoY rise.

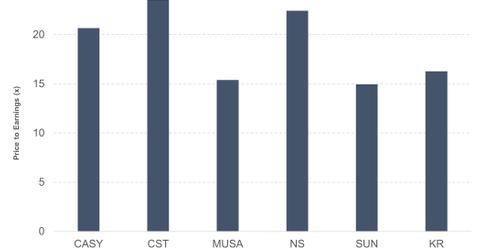

Comparing Casey’s valuations to its peers’

Casey’s is currently trading at a fiscal 2017 PE (price-to-earnings multiple) of 20.7x. The company’s current valuation is lower than that of its convenience store and fuel station peer CST Brands (CST), which is currently trading at a one-year forward PE of 23.6x.

Murphy USA (MUSA), which operates a chain of retail gas stations in proximity to Walmart stores, is trading at a PE of 15.4x. Kroger (KR), the largest supermarket company in the United States with 1,330 fuel stations, is also cheaper compared to Casey’s. It’s currently trading at a one-year forward PE of 16.3x.

Are Casey’s valuations justified?

Casey’s next-12-month earnings growth forecast is weaker compared to MUSA’s and KR’s forecasts. Both MUSA and KR are trading at discounts compared to Casey’s.

While Casey’s EPS are forecast to rise by just 1% over the next 12 months, MUSA’s and KR’s EPS are expected to rise by 32.6% and 8.2%, respectively, in the same period.

Wall Street recommendations on Casey’s

Of the 12 analysts that rate CASY, eight recommend “buys,” and four recommend “holds” on the stock. No analysts recommend “sells” on the stock.

Analysts are looking for a revival in Casey’s stock price from its current level of $119.72 per share. The target price for CASY is $129.08, which reflects an 8% return potential.

Investors looking for exposure to Casey’s can invest in the ProShares Russell 2000 Dividend Growers ETF (SMDV), which has around 1.8% of its holdings invested in the company.