An Investor’s Guide to Honda’s Valuation

On June 10, 2016, Honda had a forward EV-to-EBITDA multiple of 3.2x for the next 12 months.

Jun. 22 2016, Updated 10:04 a.m. ET

Honda’s valuation methods

There are a variety of valuation methods available to value an automaker like Honda (HMC). We believe that investors should use a combination of discounted cash flow and valuation multiples to value the company.

First, let’s use a relative valuation method based on Honda’s valuation multiples. We’ll discuss the DCF (discount cash flow) valuation method later.

Forward EV-to-EBITDA

The EV-to-EBITDA[1. enterprise value to earnings before interest, tax, depreciation, and amortization] multiple is an important relative valuation multiple. It’s generally used for capital-intensive industries such as the automotive industry (FXD).

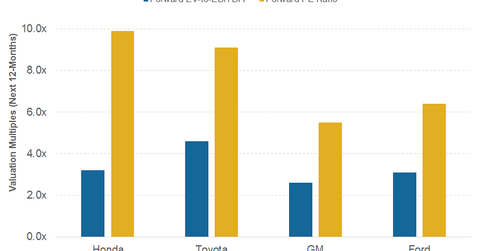

On June 10, 2016, Honda had a forward EV-to-EBITDA multiple of 3.2x for the next 12 months. This is higher than the valuation multiples of its closest peers like General Motors’s (GM) 2.6x, Ford’s (F) 3.1x, and Fiat Chrysler’s (FCAU) 1.7x for the same period.

Currently, the valuation multiples and stock price of mainstream automakers, including Honda, are in a negative trend. This could be due to the concern that US auto sales may have already peaked last year.

Forward price-to-earnings multiple

The forward PE (price-to-earnings) multiple takes into account the equity portion of a company. On June 10, 2016, Honda’s forward PE ratio, based on earnings forecasts for the next 12 months, stood at 9.9x. This was much higher than Ford’s 6.4x, GM’s 5.5x, and Toyota’s (TM) 9.1x.

GM’s and Ford’s higher dependency on the US auto market alone could be one of the reasons why Wall Street is valuing these automakers lower than Japanese automakers, including Honda and Toyota.

Discounted cash flow method

Honda Motor Company (HMC) has a mature business model with predictable cash flows, unlike new auto companies such as Tesla (TSLA). This makes the DCF method appropriate for valuing Honda’s business. However, the cyclical nature of the automotive industry could be a challenge when using the DCF method to value the company.

In the next article, we’ll discuss some key factors that may affect Honda’s valuation multiples going forward.