What’s the Rationale for the Bayer-Monsanto Deal?

In the Monsanto-Bayer deal, Bayer’s shareholders should expect to see mid-single-digit accretion to core EPS (earnings per share) in the first year and double-digit accretion thereafter.

May 24 2016, Published 9:58 a.m. ET

Bayer envisions becoming an agricultural powerhouse

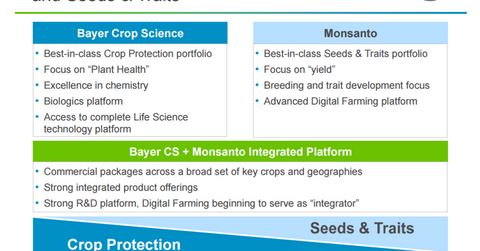

In this merger, Bayer AG envisions combining its strength in crop protection (think herbicides, fungicides, and pesticides) with Monsanto’s (MON) seeds, traits, and genetically modified products. Bayer is viewing this transaction as a way to deepen its portfolio and gain exposure to a faster-growing (albeit volatile) sector. Pro forma, the combined company would have had 23.1 billion euros in sales in 2015. Bayer’s focus on plant health and Monsanto’s focus on yield do make for a complementary transaction. That said, there’s overlap in a couple categories: Seeds & Traits and Herbicides.

Management’s comments

“We have long respected Monsanto’s business and share their vision to create an integrated business that we believe is capable of generating substantial value for both companies’ shareholders,” said Werner Baumann, CEO of Bayer AG. “Together we would draw on the collective expertise of both companies to build a leading agriculture player with exceptional innovation capabilities to the benefit of farmers, consumers, our

employees and the communities in which we operate.”

“Bayer is committed to enabling farmers to sustainably produce enough healthy, safe and affordable food capable of feeding the world’s growing population,” said Liam Condon, member of the Board of Management of Bayer AG and head of the Crop Science Division. “Faced with the complex challenge of operating in a resource-constrained world with increasing climate volatility, there is a clear need for more innovative solutions that advance the next generation of farming. By supporting farmers of all sizes on every

continent, the combined business would be positioned as the partner of choice for truly integrated, superior solutions.”

Impact on earnings

Bayer’s shareholders should expect to see mid-single-digit accretion to core EPS (earnings per share) in the first year and double-digit accretion thereafter. Bayer also expects annual synergies of about $1.5 billion after three years.

Other merger arbitrage resources

Other important merger spreads include the merger between Cigna Corporation (CI) and Anthem (ANTM), which is set to close at the end of 2016. Another large chemical merger is between DuPont (DD) and Dow Chemical (DOW). For a primer on risk arbitrage investing, read Merger Arbitrage Must-Knows: A Key Guide for Investors.

Investors who are interested in trading in the agriculture sector can look at the VanEck Vectors Agribusiness ETF (MOO).

In the next part of this series, we’ll explore the next steps in the Bayer-Monsanto deal.