Why Southern Copper Is Trading at a Premium to Freeport-McMoRan

Southern Copper has historically traded at a premium to Freeport.

Nov. 20 2020, Updated 11:35 a.m. ET

Trading at a premium

As discussed in the previous part of this series, Southern Copper (SCCO) is trading at a significant valuation premium as compared to Freeport-McMoRan (FCX). Having said that, it doesn’t necessarily mean that Freeport is undervalued at these levels. We’ll discuss these valuations in detail in this article.

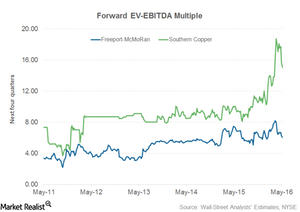

Historical premium

Southern Copper has historically traded at a premium to Freeport as can be seen in the graph above. Southern Copper has an average forward five-year EV/EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) of 8.9 as compared to 5.0 for Freeport. It’s important to note that the valuation gap between FCX and SCCO only widened after Freeport diversified into the energy exploration business. Freeport’s debt soared after it acquired energy assets at the end of 2012. Theoretically, EV/EBITDA is capital-structure-neutral. However, more financially leveraged companies generally trade at a discount to companies with lower financial leverage.

Also, Southern Copper’s stock price has been supported in the past, as its billionaire owner, German Larrea, has been increasing his stake. Few mining companies have the privilege of a billionaire buying their stock during troubled times.

Current premium

Nonetheless, Freeport’s current valuation premium is much higher as compared to what we’ve seen historically. Some part of this premium could be attributed to Freeport’s huge debt burden, which the company is working to reduce. Freeport has already announced asset sales of ~$4 billion year-to-date. You can read more about Freeport’s asset sales program in our series Understanding the Strategic Importance of Freeport’s Asset Sales.

You can consider the SPDR S&P Global Natural Resources ETF (GNR) to get diversified exposure to international natural resources companies. Together, BHP Billiton (BHP) and Glencore (GLNCY) form ~7.3% of GNR’s portfolio.

Continue to the next part of the series to explore more about Freeport’s relative valuation.