Must-Know Facts about MALAX

MALAX aims to invest in sector leaders, stocks that “can maintain, or achieve in the future, a dominant position within their respective market.”

Mar. 7 2016, Updated 4:59 p.m. ET

Mirae Asset Asia Fund

The Mirae Asset Asia Fund aims to invest in stocks that the fund house deems “sector leaders.” The fund house defines sector leaders as those companies that “can maintain, or achieve in the future, a dominant position within their respective market.” The fund house considers Asia to include China (including Hong Kong and Macau), India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, and Thailand. The fund is managed by Rahul Chadha.

Sector leaders need to be highly ranked, which means that they should be—or should be expected to become—dominant in their respective countries, regions, industries, products produced, or services offered. MALAX does not have a market capitalization bias.

Portfolio composition

As stated in the fund’s literature, information technology was the single-largest sectoral holding of the fund and formed one-fifth of its portfolio as of December 2015. It was closely followed by consumer discretionary stocks, which formed 19% of MALAX’s assets.

Financials rounded off the fund’s top three invested sectors. Compared to the MSCI AC Asia ex Japan Index, the fund is overweight in the consumer discretionary, consumer staples, and healthcare sectors. On the other hand, it’s underweight in the financials, industrials, and information technology sectors, among others. The fund is not invested in the materials sector.

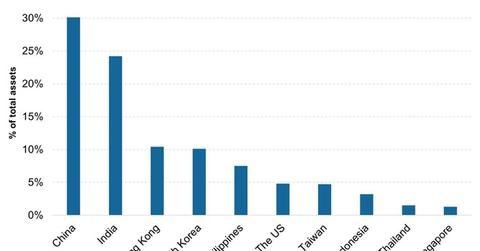

China was the biggest invested geography in December 2015, making up 30.1% of the fund’s assets. Indian equities followed, making up 24.2% of the fund’s assets. Stocks from Hong Kong, South Korea, and the Philippines rounded off the top five invested geographies. Compared to the index mentioned above, the fund is overweight in Indian and Philippine equities, and it’s underweight in South Korean and Taiwanese equities, among others.

HDFC Bank (HDB), China Biologic Products (CBPO), Tata Motors (TTM), Melco Crown Entertainment (MPEL), and China Telecom (CHA) were among the fund’s 51 holdings as of February’s end 2016. As of February, the fund was managing assets worth $23.3 million.

Fee and minimums

The Mirae Asset Asia Fund Class A (MALAX) has existed since September 2010 and has an expense ratio of 1.7%. You require a minimum of $2,000 to invest in this fund via Class A shares, and it can charge a maximum sales charge of 5.8% of the offering price. The minimum limit for additional investment is $100.

In the next article, we’ll look at some of the key metrics of the fund’s performance in the one-year period ended February 2016.