A Look at Apollo’s Definitive Deal to Acquire The Fresh Market

Apollo Global Management (APO) announced today, March 14, 2016, that it has entered into a definitive agreement to acquire The Fresh Market (TFM).

Aug. 18 2020, Updated 5:16 a.m. ET

About the deal

Apollo Global Management (APO), an American private equity firm, announced today, March 14, 2016, that it has entered into a definitive agreement to acquire The Fresh Market (TFM), a US-based specialty grocery retailer, for $1.4 billion. According to the terms of the deal, The Fresh Market has 21 days to solicit alternative acquisition proposals. Kroger (KR), KKR & Co. (KKR), and TPG Capital are some of the other reported participants.

“We are excited about this transaction with Apollo, which recognizes the value of The Fresh Market’s strong brand and significant growth prospects while providing stockholders with an immediate and substantial premium,” said Rick Anicetti, The Fresh Market’s president and chief executive officer.

Terms of the deal

Apollo has agreed to pay $28.50 per share in cash to TFM shareholders. That includes a premium of 24% to the closing share price on March 11, 2016, and a premium of approximately 53% over the February 10, 2016, closing share price. That was the day Reuters reported about a potential buyout of TFM. TFM stock soared ~23% in early trading today after news of the acquisitioin.

Why was TFM looking for a buyer?

In October 2015, The Fresh Market announced that it was conducting a strategic and financial review of the company’s business, which could result in a possible sale of the company or a change in its capital structure.

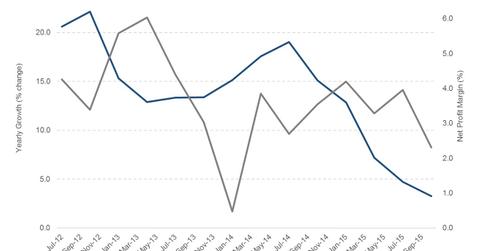

The company had a tough year in 2015. It reported a continuous decline in same-store sales during the first three quarters of the current fiscal year. Reported same-store sales were -3.7% in fiscal 3Q16, the company’s last reported quarter. TFM’s same-store performance has been particularly unimpressive compared to peers such as Kroger, which registered sales comps of 3.7%. Sprouts Farmers Market (SFM) registered same-store sales growth of 7.8% during its last reported quarter. TFM’s poor operating and financial performance resulted in a 40% decline in its stock price during 2015.

Investors looking for exposure in The Fresh Market (TFM) can invest in the SPDR S&P Retail ETF (XRT), the Vanguard Small-Cap Growth ETF (VBK), or the Barron’s 400 ETF (BFOR). XRT invests 1.1%, BFOR invests 0.27%, and VDC invests 0.13% of their holdings in TFM.