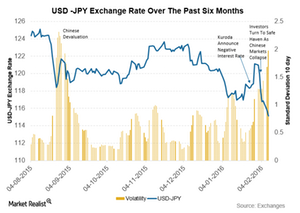

Why the High Volatility of the Japanese Yen in Recent Months?

The US dollar–Japanese yen currency pair has been one of the most volatile developed country currencies in the past six months. The Japanese yen saw heavy appreciation in August.

Nov. 20 2020, Updated 1:58 p.m. ET

Chinese devaluation sparks flight to safety

The US dollar–Japanese yen currency pair has been one of the most volatile developed country currencies in the past six months. The Japanese yen saw heavy appreciation in August when the People’s Bank of China announced the devaluation of the yuan. The devaluation resulted in a fall in most Asian currencies. But the yen, with its safe-haven status, withstood any downside and instead showed appreciation as investors took funds from emerging markets and went to safer developed economies.

The iShares MSCI All Country Asia ex Japan ETF (AAXJ) and the Vanguard FTSE Pacific ETF (VPL) were some of the most affected ETFs during the devaluation.

Japanese yen fall after Bank of Japan’s monetary policy

The Bank of Japan, in its most recent monetary policy release, decreased the deposit rates of new deposits to negative territory. This was an attempt to weaken the currency and infuse further liquidity to an economy that’s fearing negative inflation. For more details on the recent monetary policy, read the Market Realist article Bank of Japan Surprised the Markets with a Negative Interest Rate.

This resulted in a slight depreciation of the yen toward the end of January 2015. Some of the ADRs (American depositary receipts) that would have a direct impact because they’re into commercial banking include Mitsubishi UFJ Financial Group (MTU), Sumitomo Mitsui Financial Group (SMFG), Mizuho Financial Group (MFG).

Japanese yen recently posted gains

There’s recently been a strong bounceback in the Japanese yen. It can be attributed to the following:

- strong fundamental data releases in terms of the current account and economic outlook

- the US FOMC (Federal Open Market Committee) members taking a dovish view on a further interest rate hike in March

- investors looking at current market conditions, making them uncertain and once again looking to safer currencies such as the Japanese yen

The volatility of the Japanese yen is expected to continue, with the Japanese yen showing intrinsic strength. The Bank of Japan is looking to depreciate the currency in order to bolster exports.