Mylan’s Business Model: A Key Investor Rundown

In 2014, Mylan earned about 85% of its total revenues from the US generic market, which is the largest generic market in the world.

Jan. 6 2016, Updated 8:08 a.m. ET

Mylan’s business model

International pharmaceutical heavy hitter Mylan NV (MYL) generates revenue in two ways: through product revenues and through revenues from its manufacturing business.

Mylan’s product revenues

Product revenues are further classified into two categories: generic pharmaceuticals revenue and specialty pharmaceuticals revenue.

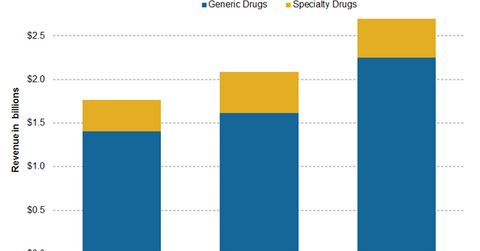

In 2014, Mylan earned about 85% of its total revenues from the US generic market, which is the largest generic market in the world. Mylan’s generic pharmaceutical product portfolio is made up of about 360 products, of which approximately 270 are either in capsule or tablet form. According to a survey conducted by Mylan in 2014, it was concluded that out of every 13 prescriptions for generic drugs in the US, one prescription was for a Mylan product.

What’s driving Mylan’s revenues?

In 3Q15, Mylan’s revenues from generic pharmaceutical business increased by 39.1% on YoY (year-over-year) basis, from $2.1 billion in 3Q14 to $2.7 billion. This increased revenue is the result of heavy demand for FDF (finished dosage form) ARV (antiretroviral) products used in the treatment of HIV and AIDS.

Mylan’s specialty pharmaceutical product portfolio is made up of several blockbuster drugs, including EpiPen Auto-Injector, Perforomist, and Ultiva. In 2014, Mylan earned more than $1 billion from EpiPen auto-injector, used in the emergency treatment of life-threatening allergic reactions like anaphylaxis. According to WebMD, anaphylaxis is a “severe, potentially fatal allergic response that is marked by swelling, hives, lowered blood pressure and dilated blood vessels.”

In 2014, Mylan also launched ULTIVA drug, used for general anesthesia during surgery.

Revenue from manufacturing business

Mylan operates its API (active pharmaceutical ingredient) business through Mylan India, one of largest API manufacturers in the world. The API business manufactures a large number of FDF drugs for ARV market and has a product portfolio made up of more than 300 APIs.

Similar to peers Takeda Pharmaceuticals International AG (TKPYY), Valeant Pharmaceutical International (VRX), and Zoetis (ZTS), Mylan has been actively involved in diversifying into different product categories and expanding into new markets. In 2014, Mylan also added new products in therapeutic categories such as oncology and critical care.

Investors can get diversified exposure to Mylan’s stock by investing in the PowerShares Dynamic Pharmaceuticals Portfolio ETF (PJP), which has 4.1% of its total holdings in Mylan.

Continue to the next part of this series for an interesting look at the EpiPen auto-injector.