How the Fed Interest Rate Hike Is Expected to Affect Gold Prices

The Fed rate hike has been a major driver for gold prices since mid-2015. Higher interest rates usually diminish gold’s appeal due to its non–interest yielding nature.

Nov. 30 2015, Published 2:06 p.m. ET

The Fed rate hike

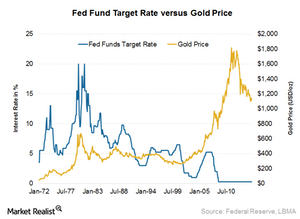

The Fed rate hike has been a major driver for gold prices since mid-2015. Higher interest rates usually diminish gold’s appeal due to its non–interest yielding nature. It might be helpful to investigate the previous rate hike cycles in the United States to gauge the likely impact of a hike on gold prices.

Previous rate hike cycles

During previous Fed rate hike cycles that got underway on February 4, 1994, June 30, 1999, and June 30, 2004, gold prices rose during the first six months when the first hike was announced. So, while the real interest rate is an important factor affecting gold prices, the macro set-up prevailing at the time of the hike is equally important to consider.

In the hiking cycles of 1994 and 1999, gold prices rose sometime after the interest rate hikes mainly because inflation was on an uptrend. Investors bought gold mainly as an inflation hedge. With an increase in inflation, real interest rates didn’t increase as much as expected. But in the hike cycle of 2004, while inflation was under control, the market was expecting the US dollar to fall further. This helped gold’s safe haven appeal and prices appreciated. The launch of physical gold ETFs during the 2004–2006 period also helped gold prices. During this period, about 600 tons of gold were added to physical ETFs.

Are things different this time?

This time, however, the inflation factor is missing and the outlook on the US dollar is also strong, as we discussed previously in this series. While there are still medium- to long-term factors supporting gold prices, in the short term and over six months or so, gold prices should still be dictated through the Fed’s rate actions. This should lead to pressure on gold prices, which in turn would be negative for companies such as such as Aurico Gold (AUQ), Franco-Nevada (FNV), Yamana Gold (AUY), and Barrick Gold (ABX). This would also affect ETFs such as the Direxion Daily Gold Miners Bull 3X ETF (NUGT). These four companies make up 16.6% of the VanEck Vectors Gold Miners ETF (GDX).