Will VF Corporation’s Vans Brand Spur Higher Growth in 3Q15?

VF Corporation saw sales of $2.5 billion in 2Q15, up 4.7% year-over-year. Its performance was boosted by top brands The North Face, Timberland, and Vans.

Nov. 20 2020, Updated 4:47 p.m. ET

Analyzing VF Corporation’s expected revenue upside

As discussed in Part One, VF Corporation (VFC) is slated to declare its 3Q15 earnings on October 23, 2015. The quarter ended on September 30. The third quarter is typically the highest-grossing for VF Corporation, partly spurred by the back-to-school season and summer spending on outdoor gear.

The Outdoor and Action Sports segment or coalition is the company’s largest reporting segment, accounting for 55.6% of sales in 2Q15. The segment also includes three of VF Corporation’s top-selling brands, The North Face, Timberland, and Vans. Each of these clock over $2 billion in annual sales.

2Q15 performance review

VF Corporation beat consensus Wall Street analysts’ revenue estimates in 2Q15 for the first time in four quarters by 2.1%. The company clocked sales of $2.5 billion in 2Q15, up 4.7% year-over-year. The performance was boosted by the company’s three $2 billion brands, The North Face, Timberland, and Vans.

However, segment and company performance was affected by the higher US dollar. Segment sales grew 9% in reported terms and 16% in constant-currency terms compared to 2Q14.

3Q15 expectations

VF Corporation’s revenue is expected to grow at about the same pace as it did in 2Q15, according to the company’s guidance.

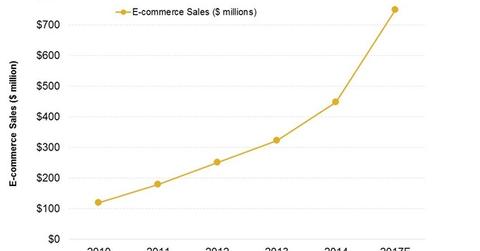

Revenue growth in 3Q15 is likely to be spurred by new store openings, higher direct-to-consumer sales, including e-commerce (electronic commerce) sales, and growth in the Vans brand. Vans reported 23 straight quarters of double-digit growth in sales in 2Q15 in constant-currency terms.

VF Corporation’s Jeanswear coalition may also see an improved business environment on strength in its Lee and Wrangler brands and higher sales in emerging markets. The segment had reported headwinds some quarters ago, as the trend for athleisurewear saw consumers shifting to yoga wear, activewear, and prints, shunning more traditional denim.

This trend has benefited companies such as Lululemon Athletica (LULU), Hanesbrands (HBI), and L Brands (LB), which have reported strong same-store sales growth trends.

However, the forex (foreign exchange) impact is expected to continue being a drag on sales. VF Corporation has left its revenue expectations unchanged in 2015, mostly due to the forex impact. However, it has revised its earnings expectations upward for 2015. We’ll discuss this in Part Three.

VF Corporation makes up ~0.52% and 0.25% of the portfolio holdings of the iShares MSCI USA Minimum Volatility ETF (USMV) and the Schwab US Large-Cap Growth ETF (SCHG), respectively.