Evaluating Gold Production for Intermediate Gold Miners in 2Q15

Gold production is an important metric for gold miners, because miners generally try to increase gold production in order to reduce costs amid low prices.

Nov. 20 2020, Updated 2:40 p.m. ET

Global gold demand and production profile

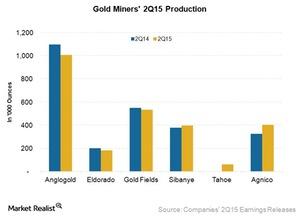

Gold production is an important metric for gold miners, because miners generally try to increase gold production in order to reduce costs in a lower gold price environment. According to the WGC (World Gold Council), gold demand fell by 12% to 915 tons in 2Q15 from 1,038 tons in 2Q14, primarily due to lower demand from its biggest consumer markets, India and China, along with challenging price environment. However, gold production went up slightly by 3% YoY to 786.6 tons in 2Q15.

Gold production growth

Agnico Eagle Mines’ (AEM) gold production grew by a whopping 24% in 2Q15, from 326 thousand ounces in 2Q14 to 404 thousand ounces in 2Q15, largely driven by the addition of a full quarter of production from its Canadian Malartic mine and increased higher grades output at its LaRonde and Pinos Altos mines. With such strong production, the company is expected to achieve total production of 1.6 million ounces in 2015.

Sibanye Gold (SBGL)’s gold production rose by 5% in 2Q15, to 399 thousand ounces from 380 thousand ounces in 2Q14, driven by its acquired Cooke mine’s gold production, which was partially offset by production loss due to load shedding.

Marginal declines

Gold Fields (GFI) reported a marginal 2% decline in gold production, from 548 thousand ounces in 2Q14 to 535 thousand ounces in 2Q15, due to the lower production from its South Deep mine and lower Greenfields exploration partially offset by improved performance from its Tarkawa, Granny Smith, and Cerro Corona mines.

Anglogold’s gold production (from both continued and discontinued operations) fell by 8%, to 1.0 million ounces in 2Q15 from 1.1 million ounces in 2Q14, while gold production from continued operations fell by 9%, from 1.0 million ounces in 2Q14 to 0.9 million ounces in 2Q15. Lower production from its biggest region, South Africa, and lower grade output drove the company’s decline in gold production. South Africa’s gold production was negatively impacted by its Mponeng mine due to safety-related issues.

Eldorado’s gold production fell by 10%, from 201 thousand ounces in 2Q14 to 182 thousand ounces in 2Q15, primarily due to delayed shipment of gold in June and lower recovery.

A new gold mine player

Tahoe Resources (TAHO) reported 60 thousand ounces in 2Q15, a number primarily driven by the acquisition of Rio Alto. Tahoe acquired Rio Alto in February 2015 in a deal totaling $1.1 billion.

The SPDR Gold Trust (GLD) mirrors gold prices in the market. Agnico Eagle Mines and Anglogold Ashanti account for 10.30% of GDX’s holdings.

While it’s important to understand the current trend of gold production, it’s more important to look at companies’ guidance for future gold production. We’ll discuss this in the next part of the series.