What is Driving the Iron Ore Miners’ Stock Price Performance?

Iron ore prices fell 49% in 2014, which was reflected in the share price performance of major miners. In this series, we’ll discuss the position of various iron ore players on the cost curve relative to iron ore prices.

Oct. 9 2015, Published 12:10 p.m. ET

Iron ore performance

Benchmark iron ore prices’ CFR (or cost and freight) have declined by 18% year-to-date. However, this fall was dwarfed by a precipitous 71% fall in iron ore prices since their peak of $194 per ton in February 2011. These attractive prices led the major iron ore producers to expand their existing capacity.

Plus, many smaller players sprang up to take advantage of attractive margins the miners were earning. China’s investment-led growth was the main engine behind this upward momentum in iron ore prices.

China’s slow growth after 2014, coupled with burgeoning supplies from miners, contributed to iron ore prices coming under increasing pressure. Iron ore prices fell 49% in 2014, which was reflected in the share price performance of major miners.

Iron ore miners’ performance

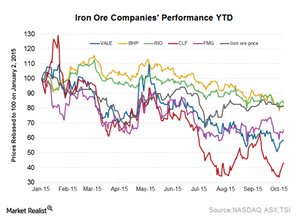

All the major iron ore miners have lost value year-to-date. On a relative basis, Rio Tinto (RIO) has outperformed, losing 16.5%, while BHP Billiton (BHP) (BBL) lost 18%. Australian miner Fortescue Metals Group (FSUGY), which is more leveraged, fell 35%.

On the other hand, the still more leveraged and geographically disadvantaged Vale SA (VALE) fell 41.5%. US iron ore producer Cliffs Natural Resources (CLF) fell 57% year-to-date. Although its US division is not directly impacted by the seaborne iron ore market, its high debt and higher steel imports into the US contribute toward its stock price fall.

Series overview

In this series, we’ll discuss the position of various iron ore players on the cost curve relative to iron ore prices. We’ll also see how their cost positions can help them weather the downturn in the iron ore industry, led by current weak demand and supply expansion. The SPDR S&P Metals and Mining ETF (XME) invests in some of these stocks. CLF forms 4.0% of its holdings.

In the next part, we’ll see how the major driver for iron ore prices, steel production, and consumption in China is expected to pan out.