Why Alcoa Did the Obvious and Is Splitting Its Value-Add Business

On September 28, Alcoa (AA) announced that it would split into two independent companies. The transaction is expected to be completed in the second half of 2016.

Sep. 30 2015, Published 12:07 p.m. ET

Alcoa splits

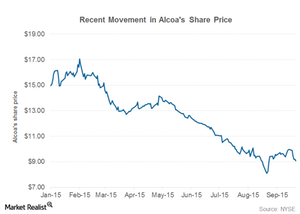

On September 28, Alcoa (AA) announced that it would split into two independent companies. The transaction is expected to be completed in the second half of 2016. Markets reacted well to the news and the stock closed at $9.59—up 5.73% from its previous day’s closing.

The chart above shows the recent movement in Alcoa’s stock. Together, Alcoa and BHP Billiton (BHP) form ~6.8% of the SPDR S&P Global Natural Resources ETF (GNR).

Was it expected?

Investors who have been tracking Alcoa for the last couple of years shouldn’t be surprised by this move. The company, which traces its roots back to 1888, has been a pioneer in aluminum production technology. Aluminum production has been the primary business of Alcoa for years.

However, under its transformation strategy, Alcoa has turned into a diversified metal company. Alcoa now is not only a primary aluminum producer but also well spread across the aluminum value chain. Along with primary aluminum, it also manufactures several alloy products to serve its customers. Alcoa has completed three major acquisitions in the last year to grow its value-add portfolio.

Final step in transformation

Alcoa’s transformation strategy is best described in its chairman’s statement during the company’s investor day last year: “We’re building these two gigantic engines. And the one engine of Alcoa is the lightweight, multi-material innovation powerhouse. And the other one is we are creating a globally competitive commodity business.”

Alcoa feels that the two engines “are now ready to pursue their own distinctive strategic direction.” In this series, we’ll explore what this split would mean for Alcoa investors. We’ll also analyze the split’s strategic implications.