Where Intel Fits in the New Semiconductor Value Chain

Huge investment is required at every stage of semiconductor development to make smaller-sized chips in a cost-effective manner without compromising on functionality.

Sep. 1 2015, Updated 11:06 a.m. ET

Why going smaller means bigger investments

In the previous part of this series, we learned that the semiconductor industry is largely dependent on R&D (research and development) for product as well as process development. Semiconductors are one of the most complex products manufactured today. As the size of the chip shrinks, the complexity increases, and the cost-effectiveness of the technology decreases.

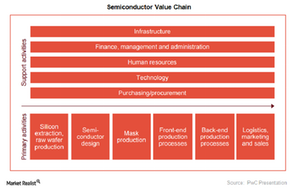

Huge investment is required at every stage of development to make smaller-sized chips in a cost-effective manner without compromising functionality. This has resulted in a model shift in the industry, in which companies specialize in individual elements of the semiconductor value chain.

Key players in the semiconductor value chain

The semiconductor value chain shown in the image above divides the industry into three specialized areas:

- Fabless companies – Companies such as Nvidia (NVDA) focus on designing new products and selling them. They don’t run any fabs (fabrication facilities) but rather outsource manufacturing to third-party foundries.

- Foundries – Companies such as Taiwan Semiconductor Manufacturing Company (TSM) run fabs and take care of all three production processes—mask, front-end, and back-end. According to Gartner, the global semiconductor foundry market grew 16.1% to reach $46.9 billion in 2014.

- IDMs (integrated device manufacturers) – Companies such as Freescale (FSL) are involved in all processes of the value chain, from design, to production, to sales. Yet even these companies are adopting a “fab-lite” strategy, in which some aspects of production—mostly front-end—are outsourced to foundries.

Benefits of the semiconductor value chain shift

In today’s world, technologies aren’t developed in isolation but rather in partnerships between these specialized companies. This helps divide the cost of bringing a new product into the market. It also allows companies to leverage R&D and manufacturing expertise.

This new partnership model saw the development of 3D XPoint non-volatile memory technology by Intel (INTC) and Micron (MU), and the 7 nm node by Samsung (SSNLF), IBM (IBM), and GlobalFoundries.

The 3D XPoint is a chip with dual memory and storage functions. It’s faster than the NAND chips currently in use. The 3D XPoint is thought to have the potential to replace NAND and DRAM (dynamic random access memory) chips currently dominating the memory space.

You can get exposure to Intel by investing in the iShares PHLX Semiconductor ETF (SOXX). Intel makes up 7.74% of SOXX.