Celgene’s EBITDA Margins Surpass Competitors

Celgene’s EBITDA margins were lower than those of its competitors. Its R&D investment appears to be higher than its peers, and its SG&A expenses have risen.

Sep. 2 2015, Updated 11:06 a.m. ET

Biotechnology margins

With the advent of new blockbuster therapies, the biotechnology sector has proved to be one of the best-performing sectors in the US.

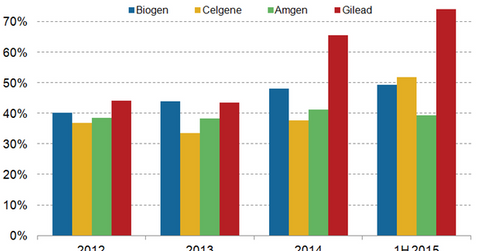

The above graph shows that until 2014, Celgene Corporation’s (CELG) EBITDA (earnings before interest, taxes, depreciation, and amortization) margins were lower than those of its competitors Amgen (AMGN), Biogen (BIIB) and Gilead Sciences (GILD). However, in the first half of 2015, Celgene reported substantially higher EBITDA margins, as the company’s key drug Revlimid won approvals for various other indications.

Celgene’s expense breakdown

Compared with its expenses in 1H14, Gilead Sciences’ total operating expenses rose by 26.7% in 1H15. In 1H15, the company’s R&D (research and development) expenses accounted for 37% of its total revenues. By contrast, Celgene’s R&D expenses, as a percentage of its total revenues, were higher than those of Amgen, Biogen, and Gilead Sciences’, by 17.8%, 18.5%, and 8.7%, respectively. Thus, Celgene’s R&D investment—an indicator of the company’s future performance—appears to be higher than its peers, given the company’s focus on developing anti-cancer drugs, both internally and through acquisitions.

Celgene is involved in various initiatives for label expansion with one of its blockbuster drugs, Revlimid. The company is currently exploring Revlimid as an ongoing maintenance drug for multiple myeloma patients, and as a second-line maintenance therapy for chronic lymphocytic leukemia and myelodysplastic syndromes. Meanwhile, Celgene is also examining Pomalyst, Abraxane, and Otezla—drugs that are expected to be blockbusters by 2017—for new indications in cancer and immunology. A substantial portion of these research programs are currently in their phase III trials and involve tests on large numbers of human subjects. A phase III trial is considered to be the costliest phase in the drug approval process, and such testing has been one of the key drivers of Celgene’s rising R&D expenses. Other company expenses have involved increases in programs in the early and middle stages of the R&D pipeline, as well as increases in new collaborative arrangements.

Compared to 1H14, Gilead Sciences’ cost of sales, or material costs, rose by 11% in 1H15, mainly due to higher net product sales. By contrast, Celgene’s SG&A (selling, general, and administration) expenses rose by 16% in the same period, due to its expanding inflammation and immunology portfolio. Additionally, selling and marketing activities for drugs such as Abraxane, Otezla, and Pomalyst have increased, and Celgene has been actively involved in donating to independent patient assistance programs in the US.

Investors can get diversified exposure to high-margin Celgene stocks by investing in the iShares NASDAQ Biotechnology ETF (IBB). Celgene makes up 8.66% of IBB’s total holdings.