Beyond the Ephemeral: Pay Attention to Demographics

Lost in all the chatter about interest rates is a structural phenomenon that may be of far greater significance: demographics.

Nov. 20 2020, Updated 3:13 p.m. ET

Lost in all the chatter about interest rates is a structural phenomenon that may be of far greater significance: demographics. Rick Rieder explains why a world that is growing old is so important to investors.

Higher rates. Lower rates. Volatility. Complacency.

As investors attempt to navigate the swirling waters that are the financial markets, it can be easy to lose sight of longer-term, structural developments in favor of more ephemeral trends and fads. But if you ignore the overwhelmingly powerful forces that are here to stay—and that will likely have a profound impact on global markets—you do so at your own peril.

Pay attention to demographics

Market Realist: The Greek debt crisis (GREK) and fears of a rate hike by the Federal Reserve have been the talk of the town for quite some time now. In the process, concerns about long-term structural changes have fallen by the wayside. It is time to adjust our vision and look beyond transitory trends. Investors need to pay attention to demographics and the dramatic shifts in trends that the world faces today.

As fertility rates continue to fall and life expectancies continue to increase, the proportion of people aged over 60 years continues to steadily increase. According to the United Nation Population Fund, one in nine people in the world are currently aged above 60 years. This figure is only slated to go up, even in emerging nations (EEM) as the quality of life and that of healthcare services continues to improve.

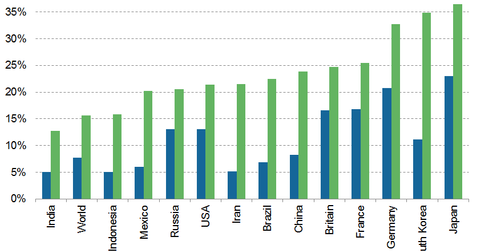

The above graph shows the proportion of population above 65 years of age by country, as estimated in 2010 and 2050. Emerging markets like India (EPI) and Indonesia are currently younger than the developed world (EFA), which is already feeling the effects of a graying population.

Japan (EWJ) is estimated to have more than 36% of its population aged above 65 in 2050. European nations (EZU) like France (EWQ) at 25.5%, Germany (EWG) at 32.7%, and Britain (EWU) at 24.7% are also grappling with the effects of an aging population. China (FXI) at 23.9% is estimated to have a higher proportion of population above 65 years than the US (IVV) at 21.4% in 2050.

How does this trend affect economic growth? Is it a cause for concern for investors? The answer is a resounding yes. We will explore this theme further in the series.