Dotcom Bubble 2.0? We Don’t Think So!

Although tech stocks have been buoyant in 2015, we don’t think that this means the advent of dotcom bubble 2.0. There are some key differences.

Nov. 20 2020, Updated 5:09 p.m. ET

This is not the dotcom bubble 2.0

I keep a pretty sparse office, but I do have a Pets.com sock puppet on my desk. It helps to remind me of the insanity of the late 1990s. The current wave looks different and may not result in dotcom bubble 2.0. Yes, there is plenty of fluff and hype. Private funding rounds are once again occurring at stratospheric valuations. There’s also a growing tendency—and this part is reminiscent of the late 1990s—for ‘me-too’ companies to attach a buzzword label, preferably ‘Big Data’, to their name and hope nobody notices the utter lack of a business model. That said, today the biggest component in the NASDAQ is… Apple. And it’s trading at a P/E ratio of less than 15x earnings, cheaper than many regulated utility companies. Plus, the new crop of companies is using asset light business models to produce real revenue at an astonishing pace.

Market Realist – Although tech stocks have been buoyant in 2015, we don’t think that this means the advent of dotcom bubble 2.0. There are some key differences between the NASDAQ of 2000 and the NASDAQ of today. This seems to indicate that there isn’t a need for tech market acrophobia.

- The dominant NASDAQ players have changed over the years. The top ten players today feature only three of the players from 2000—Cisco (CSCO), Microsoft (MSFT), and Intel (INTC). NASDAQ’s strong performance can be largely attributed to its top five constituents. Apple, Google, and Facebook have contributed to the index’s stellar performance. Apple (AAPL) has become the first company to attain a market capitalization of $750 billion. It’s the most valued company in the world.

- Most of the tech companies boast about robust earnings and strong fundamentals. The novelty of the Internet has gradually worn off and the dotcom mania has faded along with it. Today, companies are focused on growth, not utopic ideas that may or may not bear fruit. Social media (FDN) has completely revolutionized the tech sector. Despite the seasonally weak first quarter, Facebook (FB) reported a 13% YoY (year-over-year) rise in monthly active users to a whopping 1.44 billion. Apple reported record-breaking profits of $18 billion in 1Q15, the largest corporate quarterly profit in history. Then, the tech behemoth followed it up with net profits of $13.6 billion in 2Q15—its second largest earnings of all time.

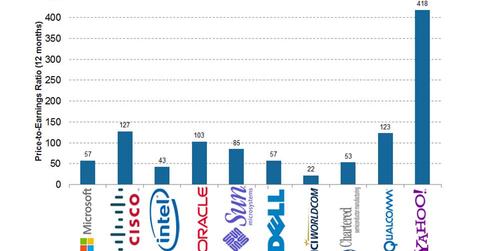

- The valuation multiples of tech companies are much more grounded than they were in 2000. The previous graph shows the valuation multiples of the top players during 2000. All of the companies had dizzying PE (price-to-earnings) multiples. The following graph shows the valuation multiples of the top NASDAQ players today.

- Apple is modestly priced at 15.7x, while Intel (INTC) and Gilead Sciences (GILD) both stand below 15x. Facebook stands at a whopping 79.5x. However, given the company’s robust earnings, its growth story seems to have legs.

Continue reading the next part of the series to understand how the tech arms race seems to be heating up.