Analyzing Lululemon’s Omni-Channel and E-Commerce Differentiators

Lululemon is testing RFID (radio frequency identification) technology and plans to implement the technology, which is currently used in ~13 stores.

Jun. 10 2015, Updated 3:05 p.m. ET

Direct-to-consumer growth drivers for Lululemon

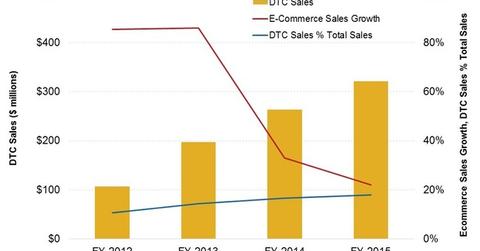

Lululemon’s (LULU) direct-to-consumer (or DTC) sales largely consist of online sales made through its websites. This is a key growth channel for the company. Revenue from DTC channels made up 17.8% of the company’s total revenues in fiscal 2015. E-commerce sales grew 22.1% year-over-year to come in at $321.2 million in fiscal 2015, primarily due to higher traffic at its e-commerce websites.

More importantly, the share of DTC and online sales in the company’s revenue pie is growing. Lululemon derived 10.9% of its sales from DTC operations in fiscal 2011—this percentage contribution grew to 17.9%. The online channel is a more important growth driver for LULU, compared with its peers NIKE (NKE), Adidas (ADDYY) (ADS.DE), and The Gap (GPS). Respectively, these companies derived 2.8%, 2.9%, and 4.8% of their sales from the web in their last fiscal years.

E-commerce enablers

LULU is cognizant of its omni-channel opportunities. Its third distribution center, located in Columbus, Ohio, came online last year. This center is expected to service shipping to Europe, as well as halve the shipping time for US customers on the East Coast.

Omni-channel drive

A key trend for online sales is the shift toward mobile and tablet shopping, to the detriment of desktop traffic. Mobile shopping accounted for a major portion of online purchases made during the holiday season for all retailers—and the percentage is growing.

Lululemon (LULU) launched its mobile app last year. The app was well received, with over 367,000 downloads and an activation rate of 76%, according to CEO Laurent Potdevin. The app generated ~8% of the company’s online sales in 4Q15.

Tech differentiators

Lululemon plans to redesign its global website this year. It is testing RFID (radio frequency identification) technology and plans to implement the technology, which is currently used in ~13 stores[1. Retail Week, National Retail Federation, LULU]. Several high-profile retailers, including Macy’s (M), have used RFID technology for several years.

This technology gives retailers (XRT) (RTH) the ability to add several layers of information to product tags, including price, style, size, and color. RFID technology may help increase sales, save time for store associates, and enable better inventory management.

LULU also uses backroom apps that allow the customer (XLY) to view online inventory and pay for purchases in the store. Potdevin noted that these apps accounted for ~6% of the company’s web sales in 4Q15.