What Do Declining US Real Interest Rates Mean for Gold?

Gold is used as an investment alternative because investors perceive it as a way to protect money’s purchasing power.

Apr. 25 2015, Updated 7:07 a.m. ET

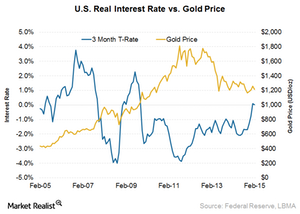

Declining US real interest rates

The three-month US real interest rates (nominal rates adjusted for inflation) declined in February. The main reason is the uptick in US inflation in February. The CPI (or the Consumer Price Index) for February was 0.0%, compared with -0.1% for January. The real interest rate was 0.01% for February, compared with 0.10% for January.

Tracking interest rates

For US real interest rates, we are using the three-month Treasury bill rate minus the year-over-year change in the Consumer Price Index. The CPI measures the price paid by consumers for a basket of consumer goods and services. We have already discussed the CPI component in the previous part of this series.

Real interest rates and gold

Gold is used as an investment alternative because investors perceive it as a way to protect money’s purchasing power. As an investment, gold must compete against other investments available in the market.

The interest rate is a major factor because it determines the attractiveness of those investment alternatives. If the real interest rate, or interest rate adjusted for inflation, goes up, then the demand for those interest-yielding assets increases and demand for gold falls, and vice versa.

Gold prices have an inverse relationship with real interest rates. As a result, declining real interest rates are positive for gold prices and gold-backed ETFs such as the SPDR Gold Trust ETF (GLD). However, real interest rates should be significant enough to shift investors from holding gold into holding interest-yielding assets.

Declining real interest rates are also positive for companies such as Goldcorp (GG), Barrick Gold Corporation (ABX), Newmont Mining (NEM), Kinross Gold Corporation (KGC), Yamana Gold (AUY), and funds such as the VanEck Vectors Gold Miners ETF (GDX). These companies combined contribute 27.1% toward GDX’s holdings.

Investors who are interested in making directional bets on interest rates should look at the iShares Barclays 20+ Year Treasury Bond Fund (TLT).